What is the forex basic principle?

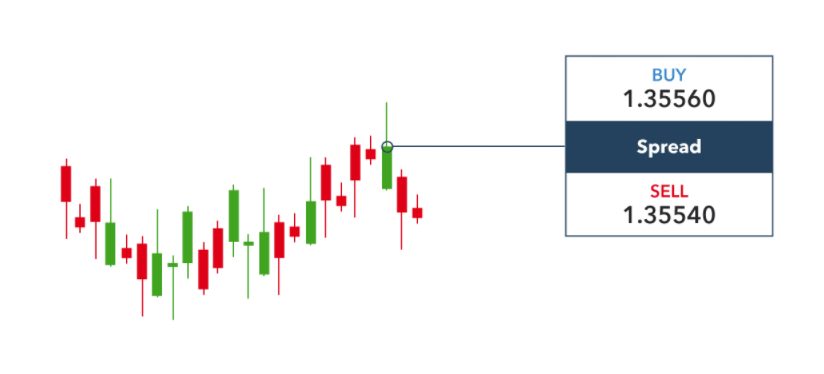

The basic principle of forex is the price formation for a specific currency. For example, the concept of “currency price” for a selected pair EUR/USD means the number of dollars for which one euro will be sold. In a forex currency pair, the first currency is always evaluated. If the price dropped to 1.5 for our pair, it means that the euro has fallen in price, and now the FX market gives one and a half dollars for it.

Is forex trading profitable?

Forex trading is a very profitable venture, but not all traders earn lucratively from this market. The difference between ordinary and successful traders is in the strategies.

According to research done by Chris Capre, an experienced forex trader, only 33% of dealers realize profits within the first three months. The lack of consistency further reduces the number. By the end of every financial year, only 7.7% realize profits.

What is the forex market strategy?

The FX market strategy is a set of rules according to which a trader buys/sells and understands under what conditions one can profit.

The strategy must contain the following parameters:

- making clear conditions of buying and selling

- determining the places where will place stops and profits

- describing the rules of risk and money management

If at least one element falls out of the system, traders will hardly profit from forex. The excellent forex player needs rules that he will follow in a disciplined manner.

Here are some lessons to help you make a profit in the forex market.

Monitor news, learn the basics, become savvy in analysis

The forex market is very dynamic. A slight change in the economy can have a ripple effect on the demand and supply of currencies. Therefore, you must be conversant with the emerging economic factors. Among them are the GDP, unemployment rate, interest rate, consumer price, industrial production indices, etc.

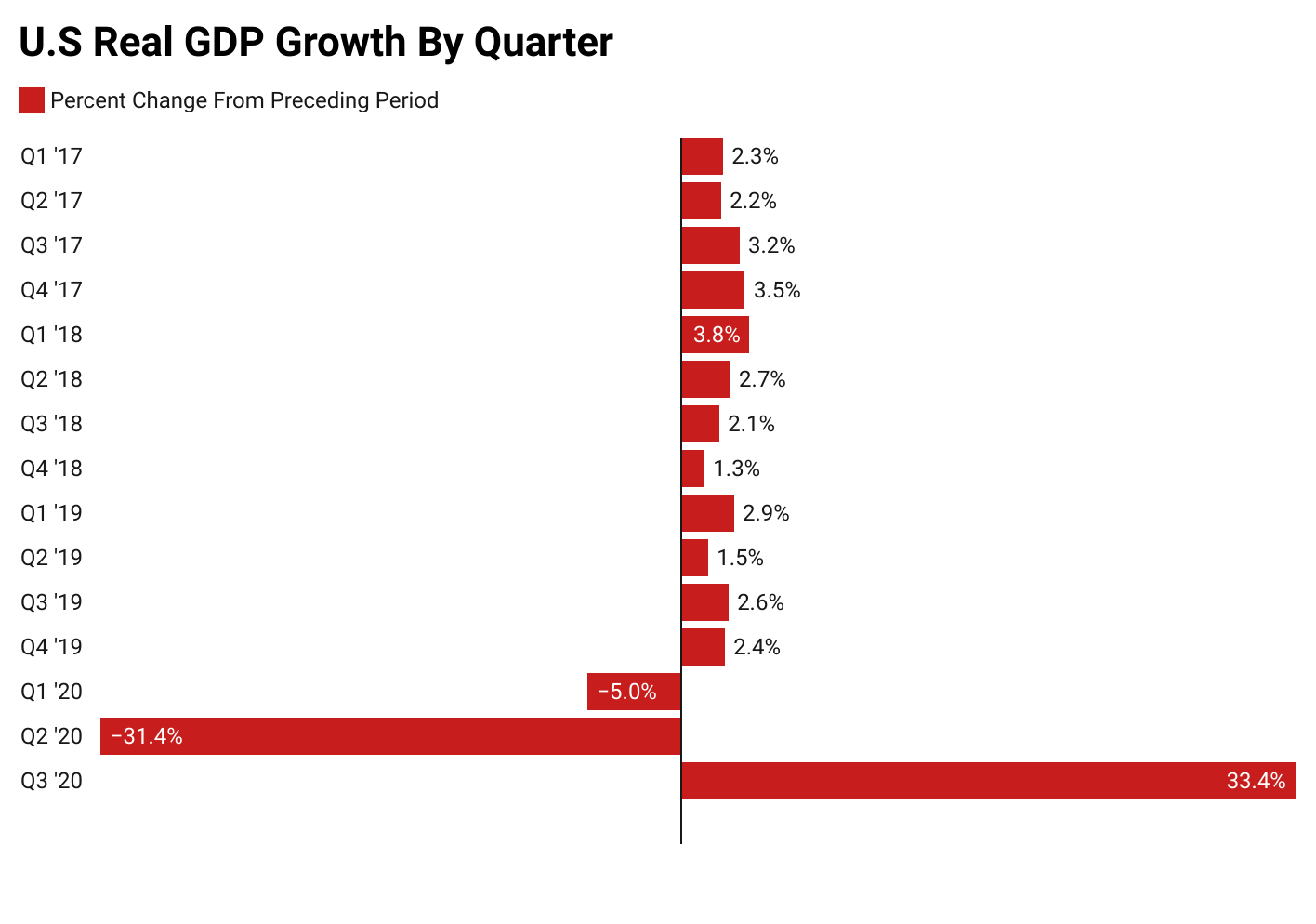

The first quarter of 2020 was marred with uncertainties because of the outbreak of the COVID-19 virus. By the second quarter, the U.S. had hit one of the lowest yet annualized GDP. Its growth of -31.4% due to mounting job losses. While most traders judged the market outlook on short-term indices like unemployment; without looking at government borrowing, the outcome is how the greenback’s global demand increased against other currencies.

Manage the risks

Diversification allows the distribution of risks by investing in different assets. This method also protects the trader from losing the deposit in case of unfavorable market conditions.

The risk-management has several advantages:

- capital protection

- yield averaging

- distribution of risks

When choosing trading instruments for making deals, a trader pays attention to the degree of correlation between them, implying a mirror movement of quotes.

The currency pairs EUR/USD and USD/CHF are considered examples of such behavior. After buying EUR/USD, a trader can diversify risks by conducting an identical transaction with USD/CHF. Simultaneously, the main principle of diversification in the forex market is observed — not to make transactions in correlated pairs in one direction.

Develop a strategy

One of the primary forex trading elements is strategizing with a particular currency, a certain amount, or money pair during the trading time. The trading plan should outlive your goals and timings, which indicate where you expect to be business-wise in the future.

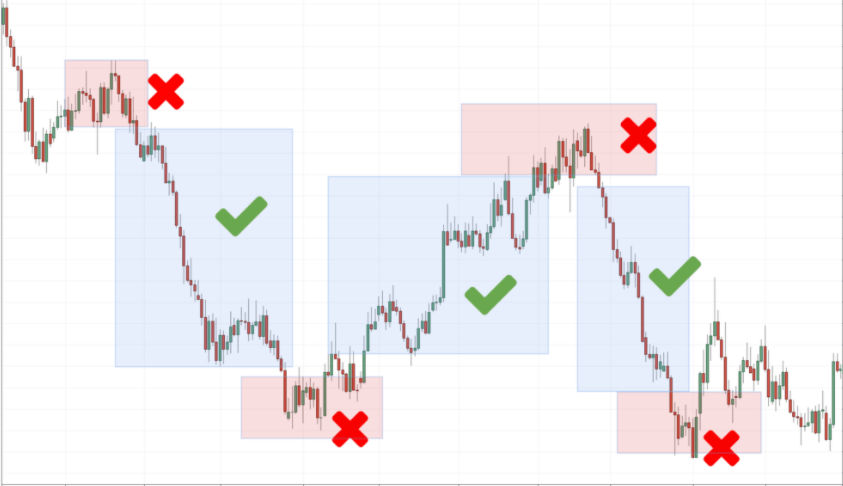

For finding a profitable strategy:

- Choose a trading time.

- Notice trend lines and swing pivots.

- Select a tool that would help determine if the market is moving upward, sideways, or downwards.

- Define the entry and exit strategy that will prevent you from incurring colossal losses.

Use the right broker

The broker you choose can either work to your leverage or compound your losses. Choose the most reputable brokers in the industry. Weigh the advantages and disadvantages of different brokers through personalized research.

The leverage

It is common for forex brokers to give traders leverage as high as 100:1. This means that for every $1,000 deposit, you can trade up to a compounded value of $100,000. Depending on the broker, some can give leverage as high as 500:1 or 1,000:1, but it is not common to find traders taking on such high levels.

The customer reviews and ratings

These points should guide you in making an informed decision. Better to read each broker’s terms and conditions in detail to get a feeling of their services. This will help you evaluate whether you can work with them or not.

The opportunities

Before settling with any broker, you should know whether they offer an over-the-counter market or spot market, all their pros & cons. Ensure that your preferred trader’s platform supports the analysis you would love to do. For example, you cannot go for Fibonacci numbers when the platform does not have Fibonacci lines.

Try algorithmic trading with robots

Algo trading with bots is an automatic program that opens positions according to its algorithm based on unique conditions and parameters. Using trading bots, you do not need to constantly monitor market changes and signals to open/close a trade in real-time.

The trader formulates the rules of his trading system, tests, and tunes it. Then the automatic trading system works on the market without the trader’s direct participation, who can only monitor the effectiveness of its work.

Conclusion

Succeeding in the forex market requires a proper strategy and experience. Therefore, it is vital to plan how to grow your profits by investing your time to learn emerging trends in the forex industry. From continuously monitoring news to becoming well-versed with technical and fundamental analysis, succeeding in the forex market requires a holistic approach and consideration.

It is crucial to plan how to propagate your profits by monitoring emerging trends like significant currency drops or capped growths. Simultaneously, use a method that considers price and volume dynamics, helping you see the most attractive deals.

Define your entry and exit point while being able to adapt to the latest market conditions. If you see that a deal is mistaken and could lead to compounded losses, closing it would cushion you from suffering immense losses.

Comments