Binary options and CFD trading both are ways to participate in the financial market. A novice participant in the financial market often faces confusion to choose the best one between these two.

Investing and managing capital is too important to have a continuous growth of an investment. So a proper approach in the financial market is essential to make an enormous return from investment.

In this article, we cover both definitions of CFD trading and binary options. We also share our research about which one is best among these two and what the reasons are.

What is binary trading?

A binary option is a financial product that involves two outcomes within a particular time. Either the outcome will be ‘yes’ or that will be a ‘no.’ There is no chance to stay between these two, just like the binary number system either ‘0’ or ‘1’.

There is no need for any trade management or anything like that. Once you enter any position with a binary option, you wait until the price reaches a certain level or reject it. You will lose your money or gain profit as much as the excellent position you make. If the price movement is positive, you will automatically receive the profit at your account, or the money you put in will be gone. This type of method offers a fixed loss or return amount.

This method involves an expiry date for any position. When the period is over, then the underlying asset position will be the scale of payout. For example, suppose the current price of share X is $10.

- You may predict this as a potential share, and the price will go above $15 by the end of this week.

- When the period ends, the price of share X can reach above $15 or remain below it by the end of the week.

- So you are willing to take a stake of $50 on this share by binary option, which will pay you a 50% return.

- If the price is $15 by the end of the week, you will automatically get a total of $75 at your account. Your capital is $50, and the profit is $25.

- On the other hand, if the price doesn’t reach $15 by that period, you will lose $50.

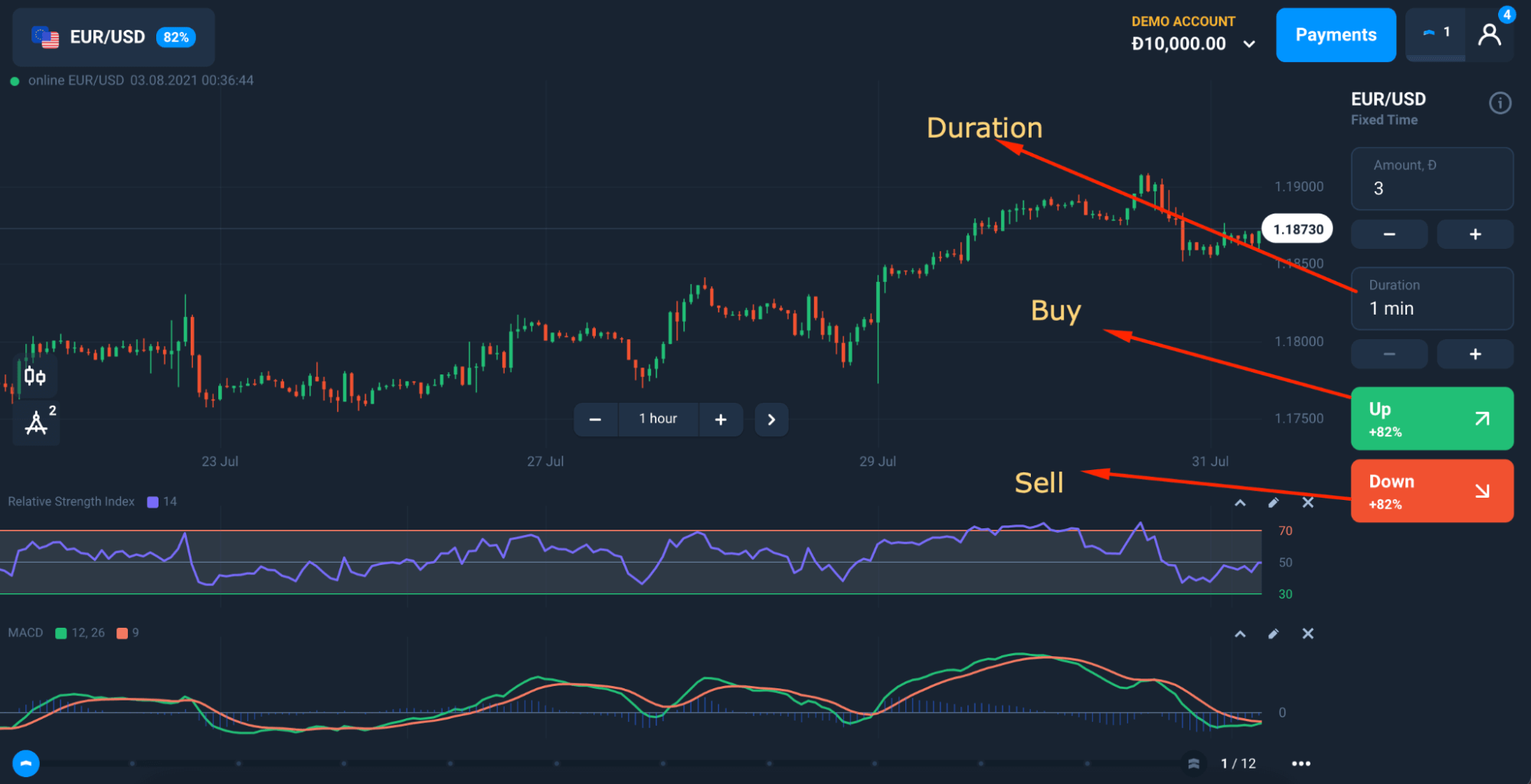

Binary trading platform

The above image shows what a binary trading platform looks like. Here, the buy/sell orders and duration is available on the right side of the platform.

What is CFD trading

The name ‘CFD’ stands for ‘contract for difference,’ which occurs between the buyers and sellers. In most cases, it occurs between the investors and the broker. CFD allows the investors or traders to make money without owning the actual asset. Moreover, the traders make money from the CFD trading from the price movement of a particular asset. The underlying asset value is not a significant concern at CFD trading; it works with the price change of the asset at a certain period and the entry-exit points of the participants.

CFD trading involves asset management. This type of investment allows investors to go for short or long at the same time and to manage investment capital. You don’t need to buy the actual asset, so low cost is involved. You open a CFD account to a particular broker and start trading on the platform that your broker provides. It is quite an easy process rather than the traditional business model.

The broker will charge some commission when you take a position (buy or sell) on a particular asset. This trading or investing method allows easy execution, and you can enter or exit from a position with just a simple click. On CFD trading, brokers offer margins to their clients so the investors can make more significant positions with a small investment.

Additionally, CFD trading allows hedge fund management. There are also disadvantages to CFD trading. Using leverage can cause investors to lose their entire capital, some broker changes spread, lack of liquidity, and maintaining margin is also essential at CFD trading.

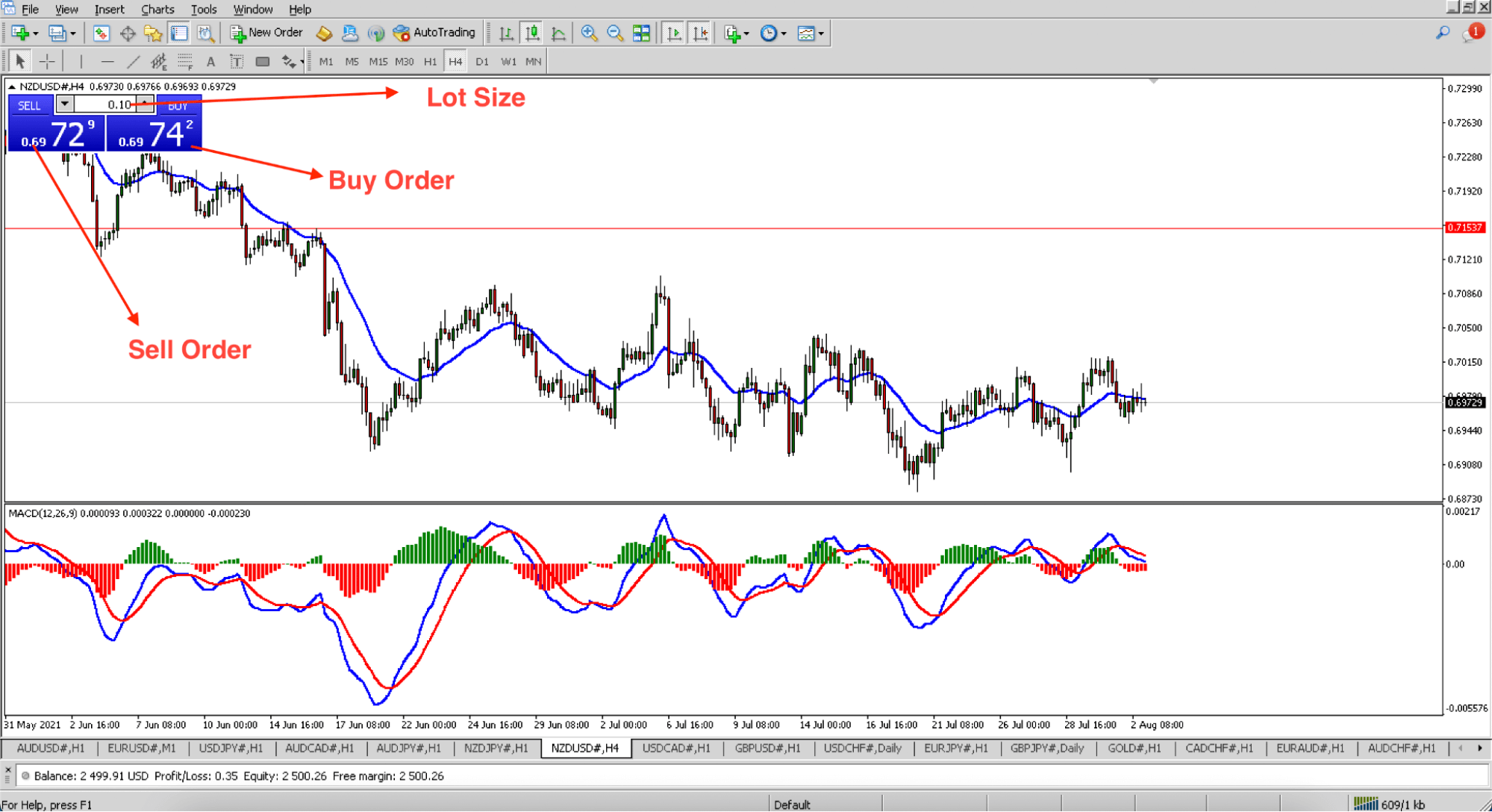

MetaTrader 4 platform

The above image shows a simple trading platform — MetaTrader 4, mainly used for CFDs trading.

Why you should choose CFDs over binary trading

Now we know the definitions of the binary option and CFD trading. It is time to choose the best one among these two. In that case, we will recommend CFDs trading over the binary option.

Let’s see why!

- We already know that the binary option is a fixed-type investment that doesn’t allow any modification of the trading capital once we enter. On the other hand, CFD trading enables trade management after entering any trade. In this way, you can minimize your loss or make corrections to your trading position.

- Moreover, the additional advantages we already know about CFD trading. You can take a more prominent position on any asset than your trading capital with the leverage option. Some brokers allow 1:500 massive leverage. You can have margin options and management of trade so you can modify or exit from trades after entering.

- This trading system allows long and short positions on the same asset, and hedging is allowable at CFD trading. None of these features is available at the binary option. So CFD trading is an advantage by any means for allowing these features.

Final thoughts

Finally, now we know the basic definition of both types of trading. So it was not that difficult to choose the best one among these two. However, when we compare it to the binary option, there are some disadvantages or limitations at CFD trading.

There are some risks associated with CFDs trading. Let’s say you want to increase your wealth by CFD trading. In that case, we suggest you gather more knowledge about the financial market, have more research and study, follow the trading-related rules and guidelines, master a profitable trading strategy, and so on.

You must check the regulation and know the terms of trading of the broker before making any deposit. Misusing leverage is a common reason that traders lose their capital, so be aware of it.

Comments