Every trader needs to have in-depth knowledge of the technical and fundamental analysis of the FX. Many market participants pay attention to these two approaches, but today dictates new conditions. Therefore, in addition to the basic methods, traders need to understand trading psychology and manage risks.

As you gain experience in trading, you will come across such a concept as currency correlation. Studying it will help you control risk as well as learn how the market functions.

By studying this instrument, you can protect yourself from unnecessary trades and excess margin. This article will find the definition and simple explanation to help you take your trading to the highest level.

What is correlation?

All currencies are dependent on each other. For example, when trading the Australian dollar and the New Zealand dollar AUD/NZD, you sell one of the forkings, the AUD/USD and USD/NZD pairs.

These currencies are correlated with each other as they are both linked to the USD. But the very movement of currency pairs is determined by many different factors: some move in one direction, while others are opposite directions.

In economics, correlation is the numerical expression of the relationship between two variables. In the FX, it means the relationship between two separate currency pairs.

- If a specific two pair moves in the same direction — the correlation is positive.

- If the moving approach is different for those two pairs — it is negative or inverse.

- If the pairs move randomly — no correlation between the two pairs.

In the FX, EUR/USD and GBP/USD are strongly correlative pairs. Every time, these pairs follow the same direction, as shown in the image below.

The above image shows how a positive correlation works in the FX by moving in the same direction. Now let’s look at an example of a negative one from the EUR/USD and USD/JPY chart.

Knowledge of correlation at the forex is essential for any trader because it often directly impacts the market, even without traders’ awareness.

For example, a trader places buy orders at two different currency pairs, which are negatively correlated. So a losing trade at any pair may be backed up by another order on another couple. The trader can also use it as a hedging strategy. Meanwhile, buying two correlative pairs doubles the risk and profit potential because both trades can profit or lose. Anyway, since they move in the same direction, they are not entirely independent.

How to spot correlation in forex?

Many factors affect the correlation, like central banks policy, global economic uncertainty, social issues, etc. Traders can quickly identify the price direction using the coefficient.

But what is a currency coefficient?

It shows how strong two currencies are correlated. The coefficient changes from +1 to -1, where:

- +1 refers to the max positive correlation

- -1 refers to the max negative correlation

On the other hand, the zero level works as a neutral correlation where currency pairs might follow the same direction or not.

The above shows the insight of correlation among forex pairs. Based on the image, the highest positive correlation is between EUR/JPY and GBP/JPY, which is 0.7872. Now let’s see the EURJPY and GBPJPY chart together.

Moreover, the most negative correlation is USD/CHF and XAU/USD. Let’s see in the chart.

In the above image, we can see that the USD/CHF moved lower from the 0.0% level to the maximum -3.4% down while XAU/USD made a maximum of 6% up.

Pros and cons

Many traders rely on one correlation in their strategy, while others consider it worthless. So let’s identify its effectiveness from pros and cons:

Pros

- It helps to identify which currency will move most after the news release.

- Positive correlation helps traders not to take many risks in the same direction.

- A negative one works well in hedging risks.

- Traders can include correlation in their strategy to identify the most reliable trade setup.

Cons

- It changes over time, so it is not possible to rely on it for a long time.

- Even if currencies are correlated, they can breach the relationship at any time.

- Investors can not take trading decisions based on a correlation only.

Simple correlation trading strategy

In the above section, we have seen how correlation works in the financial market. Next, let’s will see the practical use of the correlation trading strategy:

Trading element

- Economic calendar

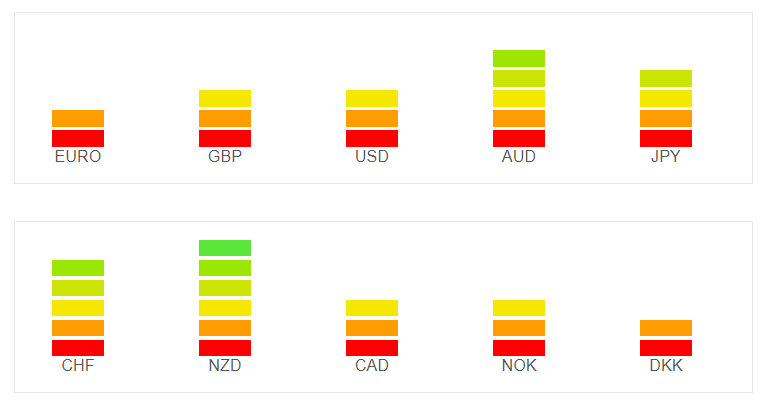

- Currency strength meter (available online for free)

How to take an entry?

- In this method, we should open multiple charts before any high-impact news release.

- If the news is positive, identify the weakest currency and take the trade against the weaker currency.

- If the news is negative, identify the strongest currency and take the trade against the strongest currency.

Example

- Let’s say the Federal fund rate will be published in a minute, and the Fed will likely raise the rate.

- Now, the present condition of the currency correlation is like this.

- Based on the image, the weakest currency is the EUR, and the strongest currency is the NZD.

- If the fund’s rate increases, open a sell position on EUR/USD immediately.

- As the EUR is the weakest among other currencies, the strong USD has a higher possibility to beat the EUR after releasing the news.

Correlation in forex: trading tips

Keep in mind that correlations are volatile, and the results alone are unlikely to be used to determine further correlations. Despite this, such information can be applied when developing your unique currency correlation strategy. In addition, it will help to reduce trading risks significantly.

- Avoid positions that cancel each other out

Currency pairs moving in opposite directions from each other make it difficult to maintain positions and reduce the potential profit from your trade.

- Diversify with minimal risk

In the long run, you can reduce your risk by investing in two currency pairs with a correlation coefficient greater than 0.

- Protect yourself from risks

Hedge two negatively correlated currency pairs to minimize your losses. For example, if one currency pair loses its value, the other is likely to make a small profit. This method will not cover losses in total, but it can significantly reduce them.

Summary

Let’s summarize this instrument by finding key points:

- Correlation stands for the statistical relationship between two different entities.

- The positive correlation takes the price in the same direction, while the negative is the opposite.

- Like other trading tools, it does not provide any guaranteed movement.

Like other trading strategies, traders should focus on trade management and risk management in the forex correlation trading strategy. For example, don’t take more than 2% risk per trade, stop loss, and take profit in every trade.

Comments