It’s been all over the news, so it would have caught your eye even if you weren’t an investor. Inflation in the United States has been on the rise. Moreover, it has been increasing rapidly over the past three months and reached a level of 5.4%, like in June 2008. That’s why some people started getting the jitters.

While the US Federal Reserve insists that inflation is transitory and that their monetary policy instruments are intentionally tilting inflation towards the higher end, some people find it hard to believe that the Fed has a steady grip on the wheel.

Inflation itself can be a tricky subject, and contrary to what many believe, it doesn’t always have to represent something terrible. Today, we will take a plunge into the very core of inflation and try to decipher what is happening at the moment.

What is the CPI?

We first have to define inflation to answer this question, as the two terms are similar but not quite the same. Inflation is a decline in the purchasing power of a currency. In our case, that will be the US dollar. With inflation, the money itself is losing value, and you can thus buy fewer things with the same amount over time.

Let’s take an extreme stance to illustrate a point. If you buy an apple for $1 in July 2021, but in July 2022, the same apple costs $2, it means that, in one year, the purchasing power of the dollar dwindled by 100% due to inflation.

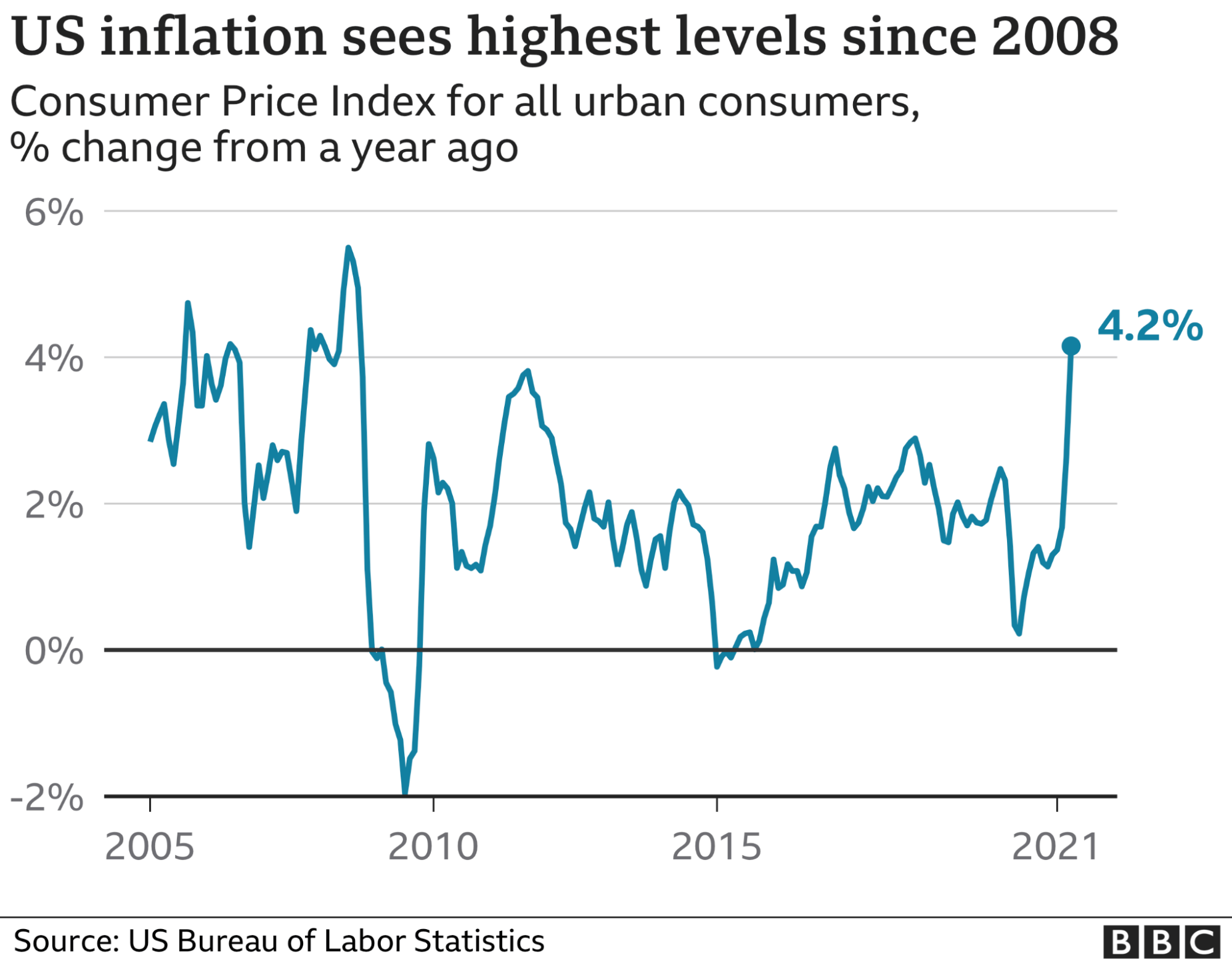

Consumer Price Index from 2005 till 2021

Since we can’t rely only on the price of apples when determining how potent a national currency is, the analysts came up with the CPI. It stands for Consumer Price Index, and it looks to quantify the general rise in prices, so it’s more easily trackable and comparable on a large scale.

In the United States, the Bureau of Labor Statistics is in charge of calculating the index, and it announces the updates once a month. The CPI figure is usually a strong mover of the leading stock markets.

How does inflation impact the dollar?

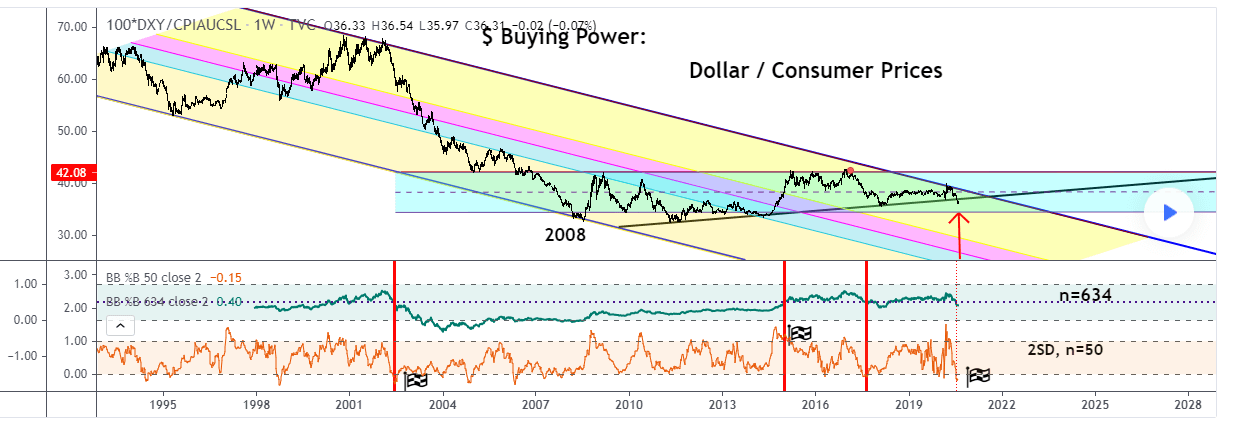

Dollar / Consumer Prices

As it can be seen from this chart, money almost constantly loses its value. That means that a dollar you have in your wallet today will not be able to buy the same amount of nearly anything in a year.

The tie between the CPI and the dollar is a pretty straightforward one. If one goes up, the other one loses some of its value. What it means for the economy and the dollar as a currency is a whole different story.

How does the CPI benefit the dollar?

One of the main upsides of inflation is that it can help the economy rebound after a crisis. If the entire economic system is not running at full speed, inflation can boost it as it tends to increase spending. The economy becomes more competitive on a global market, and the national currency, the dollar in our case, starts faring better against the currencies of other nations.

Furthermore, the depreciation of a currency, in this case, the dollar, has a beneficial effect on the debtors. The higher the inflation, the easier it is for people who borrowed money to return it later, as its value depreciates. Of course, they pay back the same amount of dollars, but that amount is worth far less than when they initially took the loan. This, in turn, usually further improves spending and makes borrowing far more appealing for investors.

Warding off dollar deflation

Lastly, some believe that inflation’s main upside is that it staves off deflation. Simply put, if the value of money decreases, it means that it’s not increasing. It sounds counterintuitive and confusing, but it makes a lot of sense.

If the money becomes more valuable, the prices will effectively drop. People, thus, believe the prices will go down even further and start feeling reluctant to buy new stuff as they wait for the goods to become even cheaper.

On an even more serious note, in the case of deflation, the debt you take on can turn out to be way more expensive than the amount that you borrowed at the start. That can make long-term debts, like mortgages, far less appealing, which can have a devastating effect on the entire banking sector, and of course, on the dollar.

Why can inflation negatively impact the dollar?

Secondly, if the inflation is too rapid, consumers can load up on the necessary items they anticipate will become much more expensive in the future. As a consequence, inflation can lead to shortages of those desired goods.

Lastly, inflation tends to get in a loop or a vicious circle. That means that once the CPI rises by a substantial percentage, the prices tend to increase even further, and your greenback starts losing more and more of its potency. The economy is stuck with a lot of cash that technically nobody wants, as it loses value too quickly.

Final thoughts

While often feared, inflation is not bad, per se, at least not in and of itself. If the inflation is moderate, it is usually a sign of a so-called “healthy economy,” which frequently rebalances the needs of its participants and constantly tries to match the inflation with an increase in wages. That doesn’t only help the domestic businesses, but also the national currency. It also helps a nation’s economy stay more competitive on a global level.

The times are risky, and there is no denying that. That’s why it will probably not be an easy feat for the Fed to find the right time and the suitable means to get inflation where they want it and do the best for the economy.

The important thing is to hedge against it, like in all uncertain times. Keeping a close eye on the Fed policy meetings, especially press conferences and interviews of some of the central banks’ presidents, will provide you with valuable insight into approaching investing and making the necessary modifications to your portfolio.

There is nothing particularly worrying regarding inflation if you are well-prepared.

Comments