True Range Pro works with the EURUSD and GBPUSD currency pairs on short time frames to trade. According to the vendor, the latter pair is more profitable as it can make up to 40% monthly profits. However, through our review, we have established that this return rate is impossible since the strategies used are inefficient. Join us as we assess the EA’s characteristics in detail.

The founder of Smart Forex Lab, Aleksei Ostroborodov, is the developer behind this robot. He has many other published products on mql5. They include but are not limited to True Range Smart, Traffic Pro, Good Morning, and Absolute FX. As far as his achievements and qualifications are concerned, not much can be said. As you can see below, the info in his profile is scanty.

The vendor’s profile

True Range Pro strategies and tests

True Range Pro trades automatically using night/intraday scalping and smart grid system. It trades during regular business hours and at night as it attempts to amass small winnings from price fluctuations. It also maps out entry and exit orders at stipulated intervals from the current market price.

The following features are also included in the system:

- Hard stop loss for each position.

- High spread protection.

- Dynamic basket takeprofit.

- Fixed and Auto volume.

- Uses the GMT+3 setting for summer and GMT+2 for winter.

- A recommended leverage of 1:100 and above.

- Prefers the following brokers: ForexChiefDirectFx, Weltrade, and IC Markets Raw Spread.

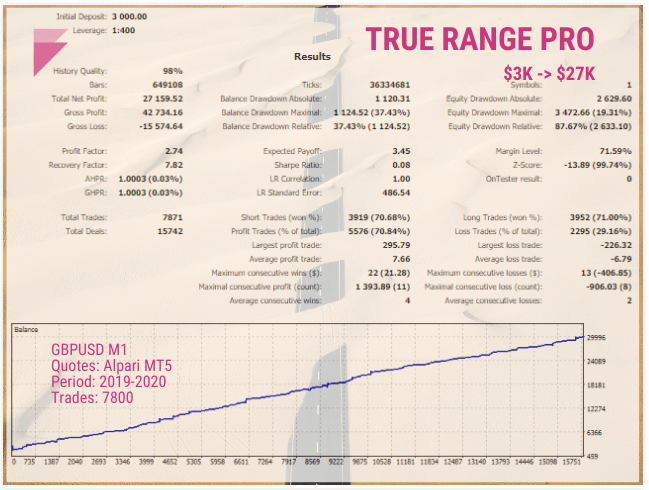

There is a backtest report for us to analyze. So, without further ado, let us see what we have.

Backtest report

The above historical data is proof that the vendor backtested the EA using the GBPUSD symbol for a year. It implemented 7871 trades and made a profit of $27,159.52 in the process. Although this profit value gives a good first impression, a closer look at the trading performance paints a different picture. Only 70.68% of the short trades and 71% of the long trades were successful. The equity relative drawdown was also massive (87.67%) and scary.

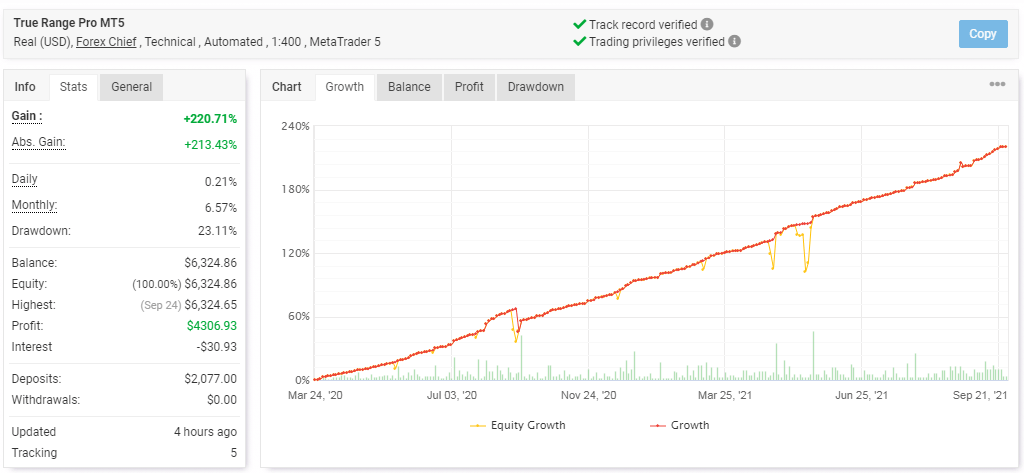

True Range Pro live trading account review

True Range’s trading stats

The data above shows that True Range Pro has not produced meaningful results yet. It only grows the account by 6.57% on a monthly basis. So, the profit made since the inception of the account about 18 months ago is $4306.93. The difference between the monthly profit rate and the drawdown (23.11%) is dangerously high. It means that the risks taken are excessive and do not coincide with the rewards obtained.

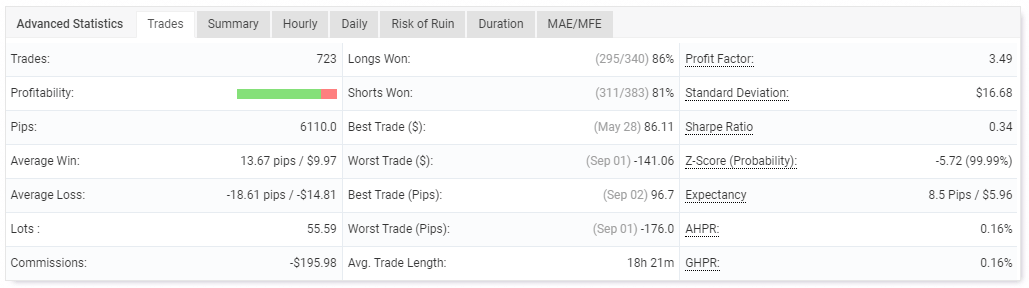

The performance of trades

The trades made are 723, and their performance is better compared to the backtest report. This is illustrated by win rates of 86% and 81% for long and short positions respectively. Nevertheless, we cannot ignore the average loss of -18.61 pips that is higher than the average win of 13.67 pips. It highlights the risky nature of the trading approach used. The profit factor is 3.49.

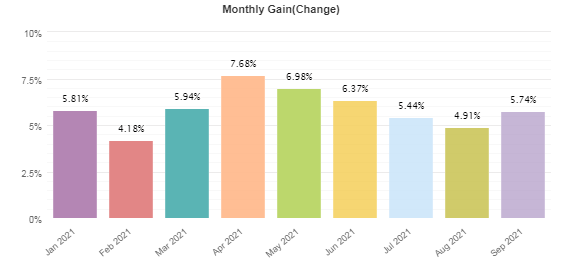

Monthly profits from January 2021 to September 2021

This data highlights the low profitability rate of the EA.

Pricing

True Range Pro’s price

True Range Pro is fairly priced. You can acquire it at a one-time price of $195. A free demo version is available as well. However, you will never get your money back in case the system does not work as desired.

Is True Range Pro EA a scam?

This system is a scam in the sense that it trades carelessly with your money. As seen earlier, it applies grid, an approach that generates relatively small profits in comparison to the risks taken. The adverse risk/reward ratio seen earlier on the trading chart illustrates this point very well. The system’s low profitability rate and the lack of vendor transparency also augment our doubt about its authenticity.

User reviews

The presentation of the EA features 10 positive customer reviews. Generally, the testimonials look phony. They are short and not as detailed as the ones we usually see on sites like FPA and Trustpilot. Consequently, we cannot take them seriously.

Comments