Tiburon EA works on both MT4 and MT5 platforms that use a dynamic take-profit feature to exit out of trades. Users can determine appropriate entry points, overbought and oversold zones, and price moments with the help of offered indicators. To help you decide whether it is a good bet to invest in, we will be talking about its key features, price, history records, and withdrawal process in this review.

Developer information

Elizaveta Erokhina is the author of the product. She is based in Russia. The developer has 5 EAs and 14 signals available in her product list. The seller has a 4.8 out of 6 on the MQL5 marketplace and has over 59 of signal subscribers. Users can reach the author via the email address given on her MQL5 marketplace profile.

Tiburon EA Strategies and Tests

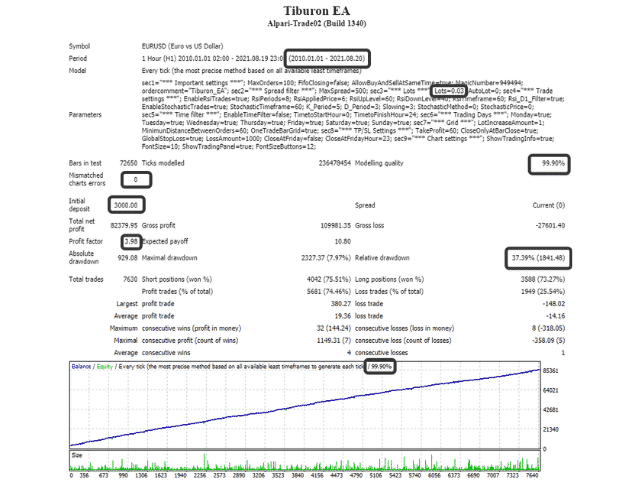

The algorithm backtesting records are available from January 2020 to August 2021 and are present in the form of an image. The initial deposited amount was $3000 and the EA had a total of 7630 trades. The total net profit was $82379.93, with a profit factor of 3.98. The robot had an absolute drawdown value of $929.08 and a relative drawdown of 37.39%

Backtesting records

Features

The algorithm offers the following:

- It allows trade in multiple currencies.

- It’s usable for both professional and beginner users.

- The robot is workable with ECN brokers.

- It uses risk management to trade.

The robot works with ECN brokers and requires a minimum deposit of $3000. The bot is centered on various trading indicators such as RSI, Stochastic Oscillator, and a custom algorithm. The combined work of several systems allows it to filter out the negative trades.

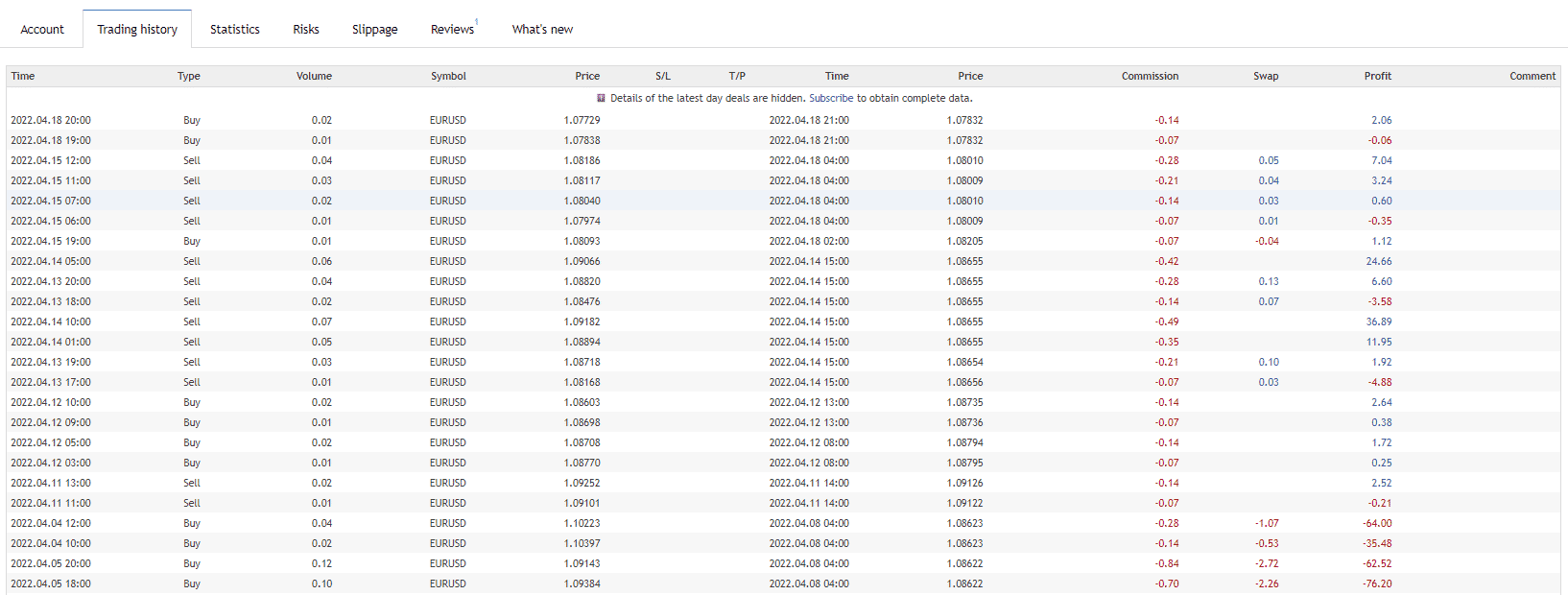

The trading history on MQL 5 records shows us that it uses grid and martingale strategies to trade on EURUSD. It also uses a drawdown control feature which exits trades once the loss exceeds a certain amount.

Live performance of the EA

Tiburon EA live trading account review

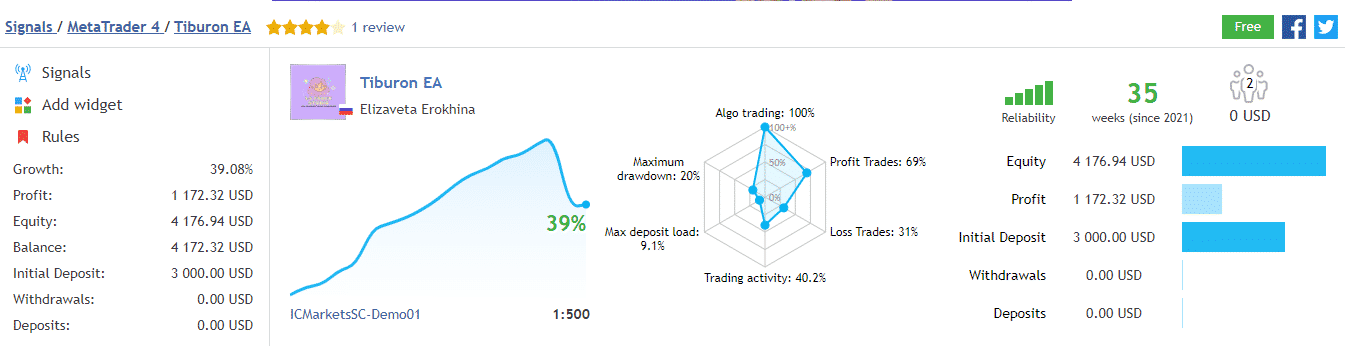

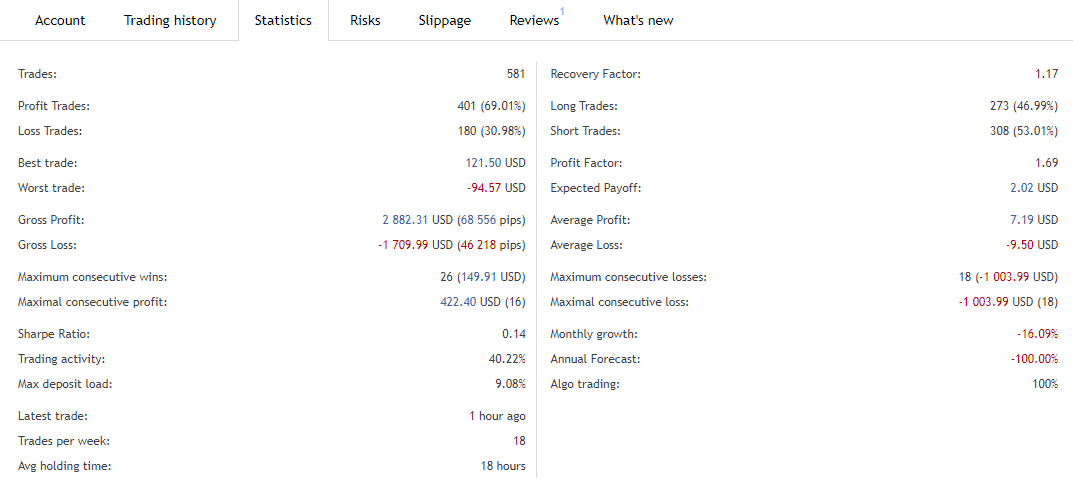

The EA started trading in August 2021 and is currently active on the MQL 5 live signals. The developer funded $3000 in their account, where the total profit is $1172.32. The growth rate was 39.08%, and the current balance of the account is $4172.32. The robot had 581 trades, out of which 401 were positive and 180 were negative.

It has the best trade of $121.50, whereas the worst is -$94.57. From the stats, the consecutive wins and losses were 26 and 18, respectively.

Live performance of the EA

Live performance of the EA

Pricing

The algorithm is available via buy and rent options from the MQL5 marketplace for $399 and $200 respectively. It is also possible to test it on a demo account. None of the offers includes a money-back guarantee.

Price of the EA on MAL5

Is Tiburon EA a good system to rely on?

The algorithm has two reviews on the MQL5 marketplace. The lack of customer feedback keeps us blind to the general viewpoint of traders about the system. One of the traders comments that the algorithm uses a martingale strategy and warns that it’s a risky aproach requiring a large capital to operate the system.

Customer feedback on MQL5

Comments