XLM, the native token powering the Stellar network, has gained growing acceptance in the recent past. The token attracts wide attention by facilitating connections with multiple financial institutions and enhancing cross-border transactions. Stellar thrives mainly in the developing economies where fund remittances and financial inclusion are still a challenge.

What is Stellar?

It is an open-source payment protocol that acts as a distributed intermediary blockchain for financial systems. The platform enables users to deploy digital assets and trade them for other assets via an in-built exchange feature. Assets on Stellar networks are issued and redeemed by Anchors, protocols issuing digital assets in exchange for deposits. Anchors are reputable entities that maintain trust in the networks. The entities allow the exchange of assets, including stocks, currencies, and crypto, through a distributed exchange.

Stellar Consensus Protocol, a modified model of the Federated Byzantine Agreement, secures the network. The protocol creates network quorums that act as nodes that relay and validate the ecosystem data. The FBA algorithm enables nodes to choose the peers they trust based on set factors.

This project was launched in 2014 by Jed McCaleb, former Ripple co-founder, and Joyce Kim. The project is a fork of the Ripple blockchain to create an affordable financial system. The activities of the Stellar network are supported by Stellar Development Foundation, a non-profit entity working towards financial access, education, and inclusivity.

If you are looking for Stellar price prediction for 2022-2025, look no further. We will look at the current XLM pricing to see what to expect from the future changes.

Stellar: should you invest in XLM today?

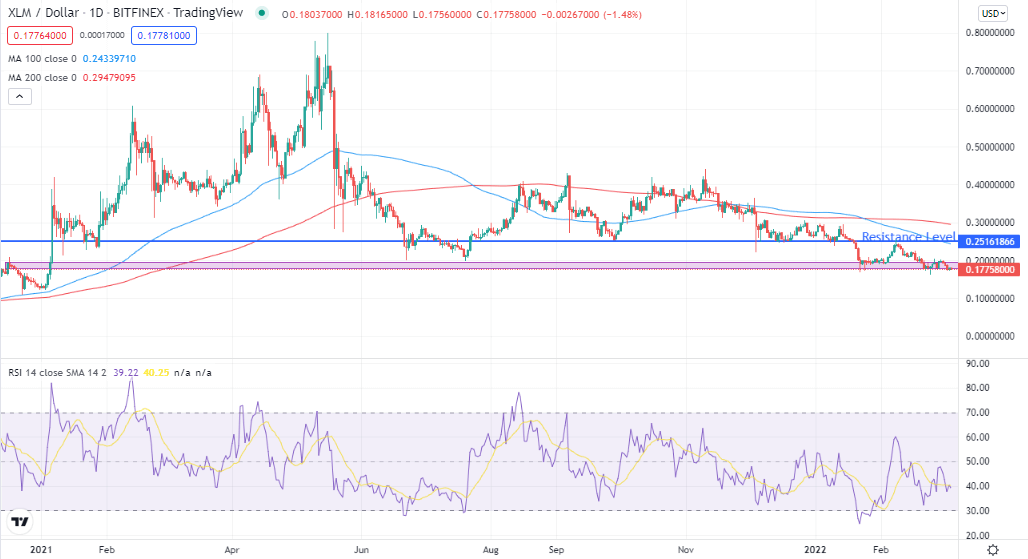

XLM may not offer quick returns for short-term investors. The daily price outlook shows that the token is facing a bearish momentum. XLM is also trading below the 100 and 200 moving averages. After facing rejection at the $0.25 resistance level, XLM has been trending in a series of lower highs and lower lows.

XLM, however, remains at a crucial support zone of $0.17. The zone could be a launching pad for a higher upward trend, but a price below could open more weaknesses to the downsides. Still, the Relative Strength Index has not crossed the oversold zone, meaning that the bears are still in control, and downward pressure is imminent.

XLM price forecast and prediction 2022-2025 (daily chart)

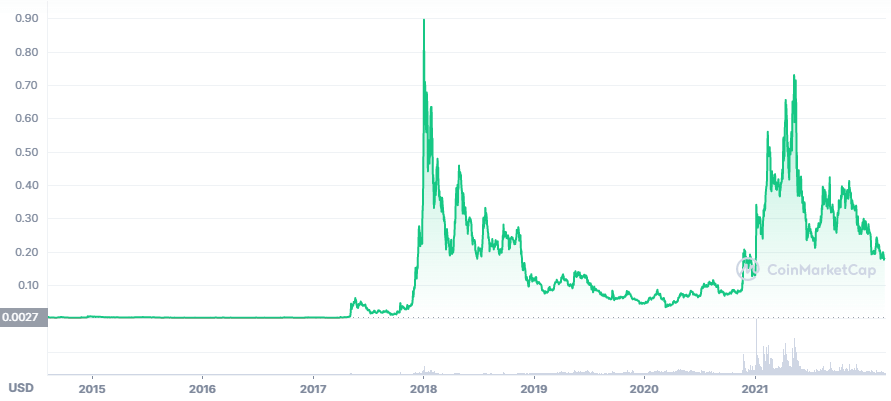

Stellar is a cryptocurrency with potential upside in the long term. The overall price outlook shows that the token is trading lower than the previous high of $0.7 recorded at the close of 2021. However, XLM is poised to rebound to the previous high with the need for efficient payment systems in the blockchain space, making it a strong asset to hold.

XLM price forecast and prediction 2022-20225 (all-time chart)

Will XLM reach 1 USDT in 2022?

- XLM traded at $0.29 at the start of 2022 before facing a bearish momentum. At the close of the year, the forecasted price is expected to be $0.28 at a minimum. The token could reach a maximum of $0.35 and an average of $0.19 throughout the year.

- The forecasted maximum XLM price in 2023 is expected to reach a maximum of $0.49 and a minimum of $0.29. The average trading price in the period will be $0.3.

- Stellar is expected to record significant gains in 2024. The token will kick off the year at about $0.51 and drop slightly to $0.34 by mid-year before closing at $0.62.

- The price prediction for 2025 puts XLM at $0.71 at a minimum and $0.9 at a maximum. The token will trade at an average of $0.4 throughout the year.

XLM past price analysis

Stellar is currently ranked at position 31 by CoinMarketCap with a market capitalization of $4,399,432,279.56. There are 24.57 billion XLM in circulation from a total supply of 50,001,788,143 and a maximum of 50,001,806,812. Lumen is currently trading at $0.1789 at, a dip of 1.28% in the past day.

Similarly, the token has been down by 8% in the past seven days from a high of $0.194. The three-month price outlook shows that XLM remains under bearish momentum. The token has shed a whopping 33% in the period. From the all-time outlook, XLM is trading lower from an ATH of $0.8963 in 2018, where the daily trading volumes reached $1.51 billion.

Want to buy XLM?

XLM is listed in major exchanges, including Binance, Coinbase, Huobi Global, and Kucoin.

To buy XLM on the Binance, follow these steps:

Step 1. Register an account with Binance.

Step 2. Buy Bitcoin directly from your account.

Step 3. Go to Spot Markets and select the XLM/BTC pair.

Step 4. Exchange BTC for XLM.

Comments