The Prop Firm EA promises to assist you to pass the funding firm challenges set by companies like FTMO and MY FOREX FUNDS. As a result, you can be awarded with a heavily funded account. The resulting earnings can then be shared with the firm. We assess the characteristics of the robot to find out if the promises can become a reality for you.

Prop Firm EA is the work of My Ea Academy, which is a part of SinryAdvice, a company famed for producing several Forex trading systems in the market. The firm is based in Malaysia. Nonetheless, the identity of the developers and traders has not been disclosed. Therefore, their qualifications and expertise on matters concerning Forex are doubtful.

Prop Firm EA strategies and tests

We are told that the EA has several features, which we have compiled below:

- Works on 25 trading pairs.

- Is fully automatic.

- Is easy to set up.

- Comes with a full setup guide.

- Works on individual accounts and funding firms’ accounts.

- Has spread control to avert trading in volatile markets.

- Martingale strategy is not used.

- Auto lot management that enables the EA to choose the lot size automatically based on the trader’s fund.

- Works on 10k, 50k, 100k, and 200k USD accounts.

The Prop Firm EA applies a combination of strategies. As the vendor puts it, the system implements a top-bottom reverse trading approach coupled with grid, internal smart indicator signals (to assess the market prior to placing a trade), and news filter (to prevent trading on big market event days).

The backtest report of this system is not shared. This is strange given that the devs insist that the robot is able to trade successfully and pass funding firm challenges. They must have tested it to come up with these conclusions. Perhaps the test results weren’t as good as hoped. So, they don’t want us to find out.

Prop Firm EA live trading account review

Prop Firm’s trading statistics

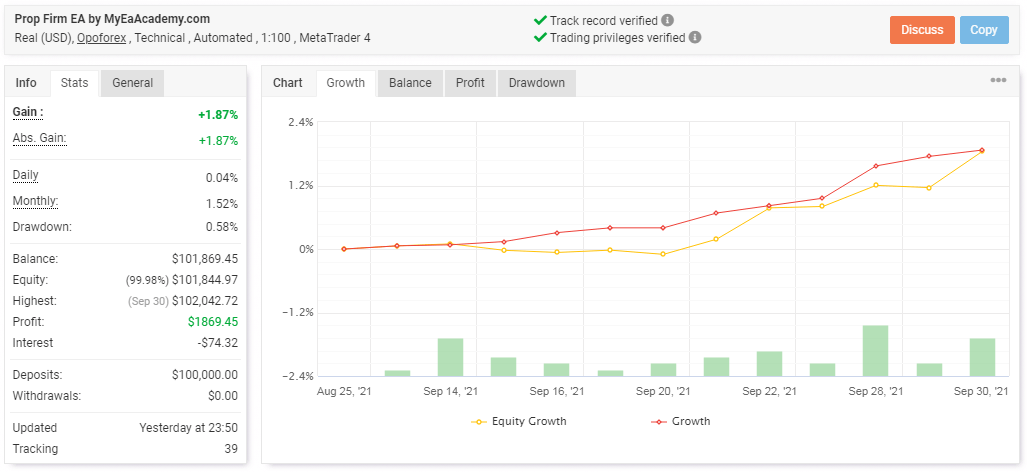

This real USD account was opened on August 25, 2021. Up to September 21, it made a 1.87% gain. The daily (0.04%) and monthly profits (1.52%) were small. The vendor was pretty much confident about this robot to have entrusted it with a huge deposit of $100,000. Unfortunately, it hasn’t grown much as a meager profit of $1869.45 has been made.

Trading performance

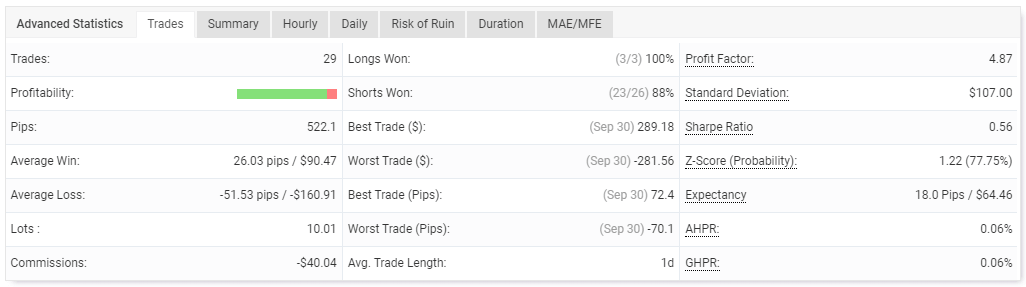

The trades implemented were 29. Out of these, 100% of the long positions and 88% of the short positions were successful. These results look impressive. However, we are concerned that the robot has made more losses than wins. This reality is portrayed by the average loss of -51.53 pips, which was nearly 2 times higher than the average win of 26.03 pips. The profit factor was 4.87.

Trading history

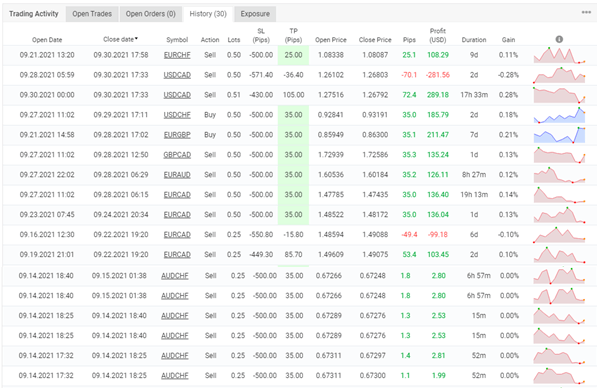

The EA didn’t trade frequently. Sometimes it stayed for days without placing any orders. The trailing stop losses used were quite big. The system traded with large lot sizes (0.25, 0.50, and 0.51) as well. In some instances, a grid of orders was placed.

Pricing

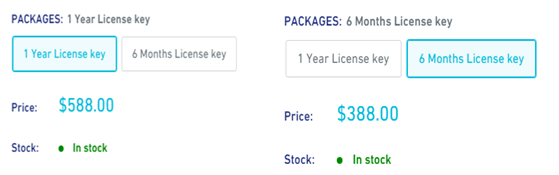

We have the 6-months and 1-year license keys that cost $388 and $588, respectively. The system’s pricing is indeed expensive. This is because, on average, EAs in the market cost between $100 and $200. A 14-day money-back guarantee is available.

Prop Firm EA’s pricing packages

Is Prop Firm robot a scam?

Through our assessment of the robot, we have concluded that it is a scam for several reasons:

- It does not pass prop firm challenges as purported.

- It does not have a past track record.

- It has a 1.5% monthly return rate, which is way below the promised monthly profit range of 10-20%.

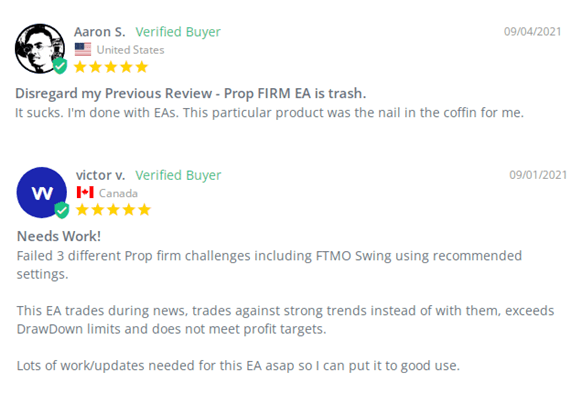

User reviews

We have several mixed customer reviews on the official website. The complaints of some traders caught our attention. As such, one buyer reveals that the EA ‘is trash’. He probably found out that it doesn’t perform as well as promised. The other one asserts that the robot failed 3 different prop firm challenges, exceeded the drawdown limits, and failed to meet the profit targets.

User reviews

Comments