Omega Trend EA claims to be one of the most successful expert advisors in the market. According to the vendor, the robot has been optimized for the market environment of the current year. However, it would be wise to analyze the EA from an objective point of view before forming an opinion about its profitability.

Omega Trend EA is a product from FXautomater. This company is based in Seychelles and it is known for building systems like BF Grid Master EA, Grid Master Pro, BF Scalper Pro, News Scope EA Pro, BF Smart Scalper EA, and Smart Scalper Pro. We don’t have an official address for the company headquarters and no information is available on the traders and programmers who work there. Thus, we can say the company does not offer much in terms of vendor transparency.

Omega Trend EA strategies and tests

This Forex EA uses 3 distinct trading schemes for dealing in Forex. The first scheme, known as trend spotting, looks for major and minor trends in the market. As per the system’s configuration, it looks for a trend that lies close to the opening of the market movement.

The next strategy is known as strategy diversity and it takes advantage of two recognizable schemes using trend indicators. Since the vendor has not revealed what these indicators are, we have no idea how the second strategy is supposed to work.

With the third strategy, Omega Trend EA makes dynamic entries and exits. Here, the EA changes its take profit, trailing stop, and stop loss positions according to the market volatility. The Omega Trend indicator shows the volatility limits in the trend. When there is a break in the main line, you know there is a major reversal or shift coming.

The robot has a money management system that calculates the trading lots according to the risk level chosen by the trader. It also has a recovery mode that enhances the lot size to compensate for past losses. This is a very risky approach that could compound your losses. You have the option of programming the system to trade during certain hours and on certain days of the week.

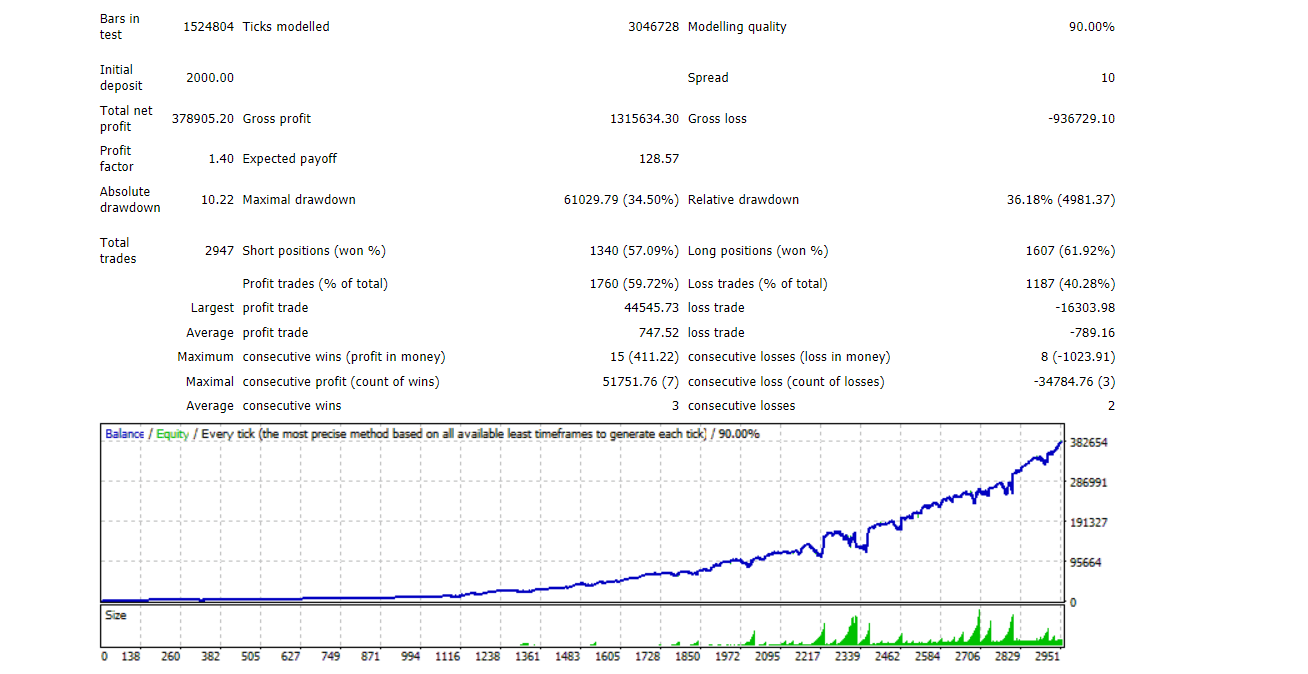

Backtesting results for EUR/JPY

This backtest was conducted on the EUR/JPY pair using archival data from 1999 to 2020. Using an initial deposit of $2000 Omega Trend EA placed 2947 trades during this backtest, winning 59.72% of them and generating a total profit of $378905.20. The win rate is a bit low compared to other automated systems. Another thing to note is the high drawdown of 36.18%, which tells us that the EA follows a high-risk approach. The profit factor for this backtest was 1.40.

Omega Trend EA live trading account review

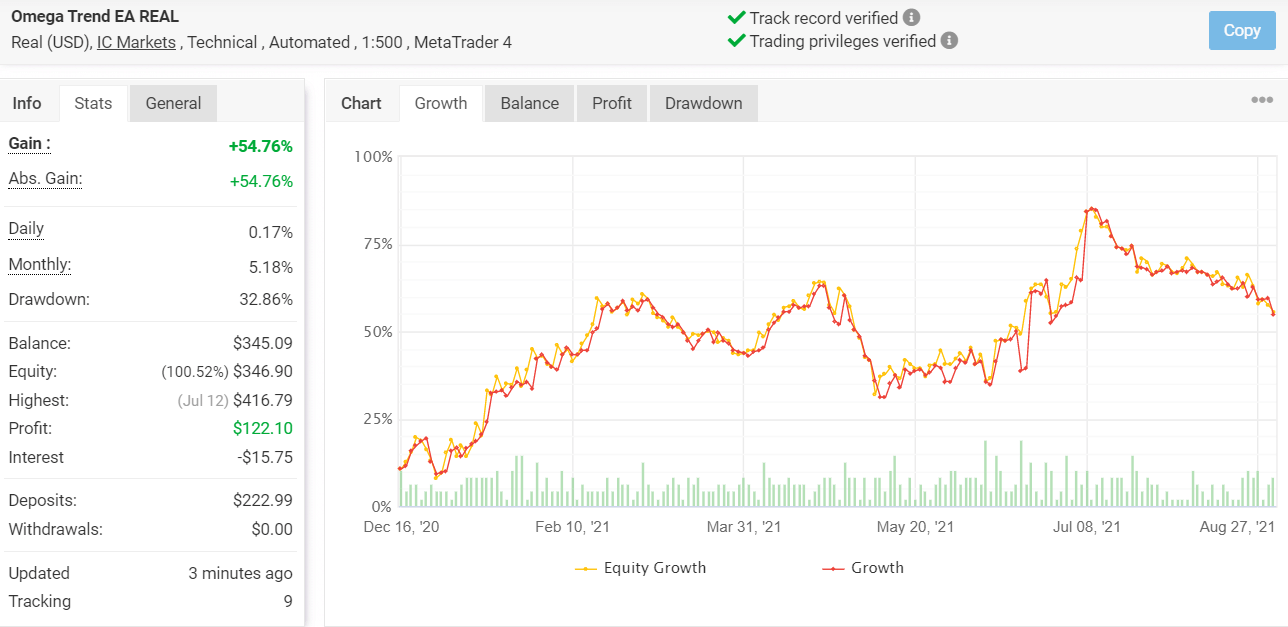

Growth chart for Omega Trend EA

Here we have the live trading statistics for Omega Trend EA, presented on the Myfxbook website. This account has a win rate of 61%, which is a bit higher in comparison to the backtest but still not that impressive. The monthly daily and monthly win rates for this account are 0.17% and 5.18% respectively, while the profit factor is 1.19.

Here also, we can see a high drawdown of 32.86%, indicating a high risk of ruin. Clearly, the system has lost a substantial amount of money while trading, as the net profit presently stands at $122.10 only.

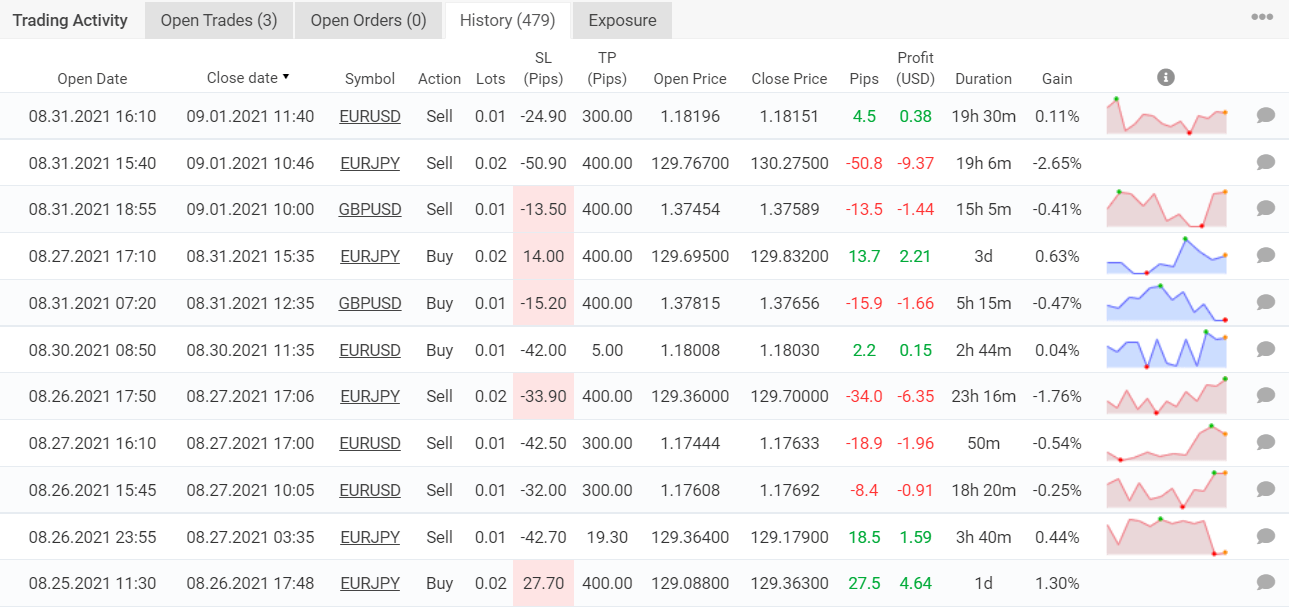

Trading results for Omega Trend EA

Taking a look at the trading history, we notice several back-to-back losses, confirming our suspicion that the EA uses a risky strategy.

Pricing

You can purchase Omega Trend EA at $97. This gives you access to a single real and 3 demo accounts. The vendor has a 60-day refund policy for this robot.

Is Omega Trend EA robot a scam?

It is very likely that this Forex EA is a scam. The vendor claims it is a profitable system, but the live trading performance is quite disappointing. Also, there is very little data available on the parent company.

We couldn’t find any user reviews for this EA on third-party websites, which indicates a lack of reputation.

Other notes

Omega Trend EA deals in EUR/JPY, EUR/USD, and GBP/USD. The vendor recommends running it on H1 charts.

Comments