Hippo Trader Pro is available at the MQL 5 marketplace, where traders can purchase it for $299. The robot is FIFO compliant and trades the market using a trend following pattern identified by the relative vigor index indicator. The algorithm has many built-in settings that can be tweaked according to the preferences of a trader. Let us go through every aspect of the robot to determine whether we should use it or not.

Hippo Trader Pro strategies and tests

To install the trading system, traders have to follow the following steps:

- Purchase the EA and refresh the experts’ tab after downloading it on the MT 5 platform.

- Attach it to the charts to start trading.

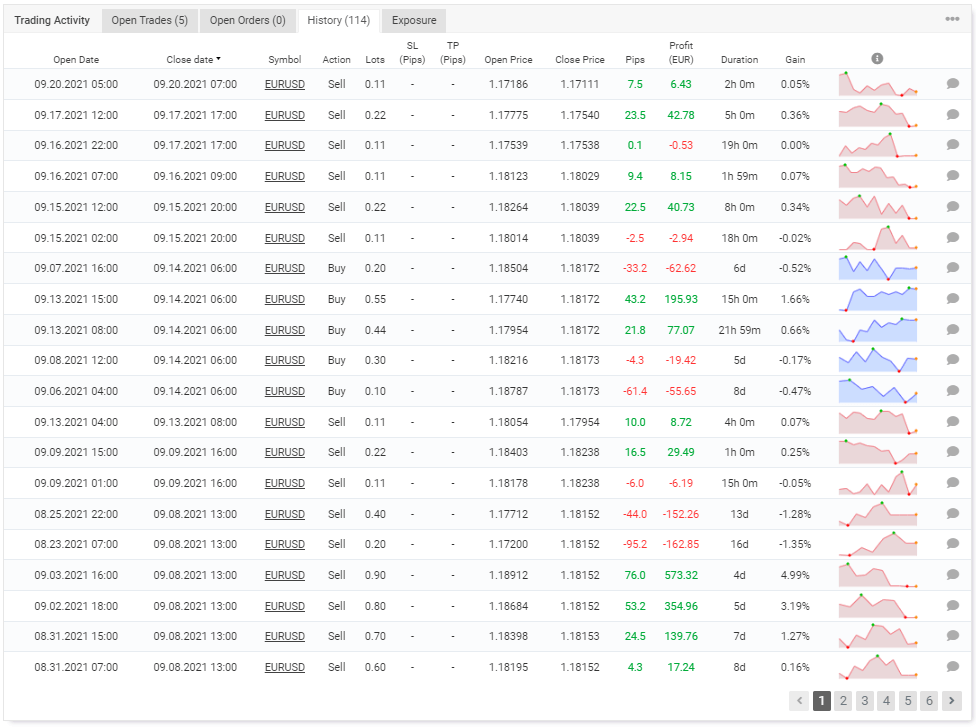

The developer states that the EA works on the M1 chart on EURUSD and uses the relative vigor index indicator to determine the market trend. It has a default globally stop-loss set at $1000, which is to be adjusted according to the risk and capital. We can easily see on the Myfxbook records that the algorithm employs grid and martingale strategies which are risky. The provider does not share this with traders as many investors know that these game plans can cause margin calls on trading accounts.

Trading history on Myfxbook

Hippo Trader Pro features

Hippo Trader Pro has the following features:

- It has multiple settings that can be tweaked.

- It has passed the stress test for the past 17 years.

- It is compliant with FIFO brokers.

- It is available for both MT 4 and 5 platforms.

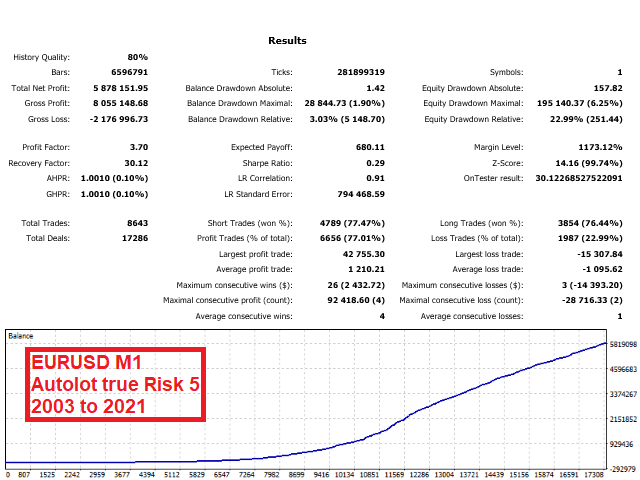

Hippo Trader Pro backtesting results

Backtesting results are available for the EURUSD auto lot. The developer only shares images with us, which is quite poor activity. On the pair, the relative drawdown was around 22.99%. The winning rate was 77.01%, with a profit factor of about 3.7. All the backtesting was done on the 1-minute chart with an unknown starting balance. The robot tanked an average profit of $5878151.95 during this period. There were 17286 trades in total. The best trade was $42755.30, while the worst one was -$15307.84.

Backtesting report

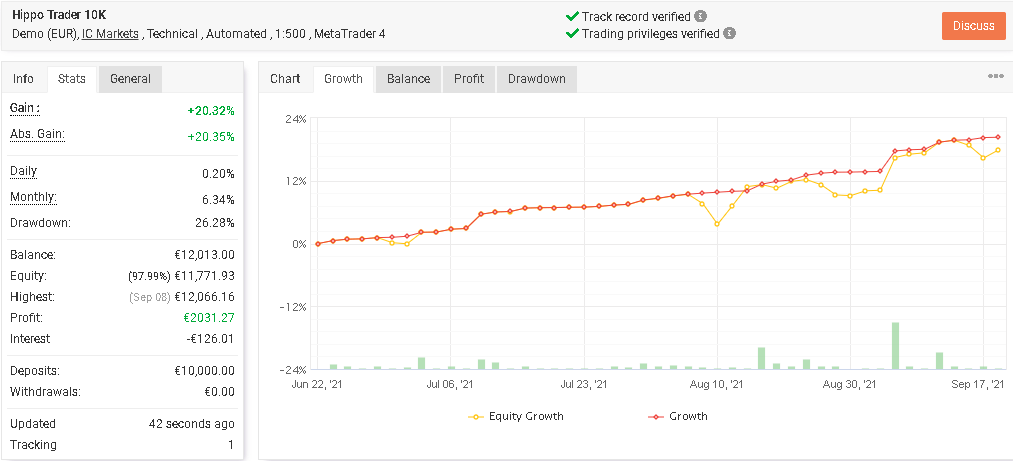

Hippo Trader Pro live trading account review

Verified trading records on Myfxbook show performance from June 22, 2021, till the current date. The system made an average monthly gain of 6.34% during the period, with a drawdown of 26.28%. The winning rate stood at 69%, with a profit factor of 2.50. The best trade was €573.32, while the worst was -€184.85. There were a total of 115 trades, with 20.61 lots traded. The results are on a demo account, which means that the outcome will be worse on a live portfolio.

Live records on Myfxbook

Pricing

The robot costs $299 and can also be rented for 1 and 3 months at $199 and $269. The license is available for one account, which the traders log in through MQL 5. There is no money-back guarantee.

Costs of using the robot

Hippo Trader Pro reputation

Customer reviews are available on the MQL 5 community. Most of them look as if they were purchased by the developer. Traders say that they are trying out the EA on their live accounts.

A customer review on TrustPilot

Is Hippo Trader Pro a scam?

The robot uses a risky grid and martingale strategy, which can cause a good amount of drawdown or even margin call on the account. Therefore it is not recommended to invest in such a system. Traders can liquidate their assets through the use of such an EA.

Comments