FXZipper is promoted as a reliable scalper robot. Although the system makes small profits, the devs appear to be pretty much confident about its performance. Some traders may be turned off by its average results, though. This review will help you decide whether enlisting the services of this product is a good move or not.

The developers of the robot have not been disclosed. Anonymous Forex vendors should make you uneasy. This is because they always have something to hide. You wouldn’t know what to expect from them. They can just mismanage your funds in the name of helping you succeed in Forex trading. Therefore, you need to be extra careful when dealing with people with zero reputation in the market.

FXZipper strategies and tests

FXZipper is based on the scalping strategy. This means that the robot generates tiny amounts of pips from every trade. The EA has a few features as well. We have listed them below:

- Trades a variety of currency pairs; AUDUSD, AUDCAD, USDCAD, GBPUSD, GBPCAD, GBPAUD, EURCHF, and EURCAD.

- Traders are advised to utilize accounts with a minimum spread like ECN, etc.

- Runs on the MT4/5 platform.

- Comes with a user manual.

- Provides 24/7 friendly customer support.

- Free updates are offered.

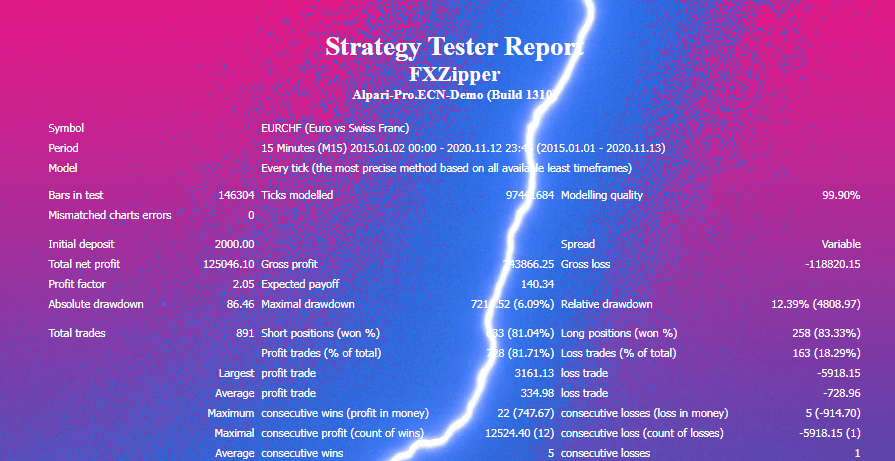

The vendor has supplied us with the backtest data. Let’s see what it says:

FXZipper’s backtesting report for the EURCHF pair

According to this data, the EA operated the account from January 2015 to November 2020 on the 15-minute time frame. The modeling quality was 99.90%. A deposit of $2000 was placed, and a total net profit of $125,046.10 came out of it. The profit factor was 2.05. The system completed 891 trades, winning 81.04% of the short trading positions and 83.33% of the long ones. The average loss trade of -$728.96 was way higher than the average profit trade of $334.98. Clearly, the system struggled to win trades.

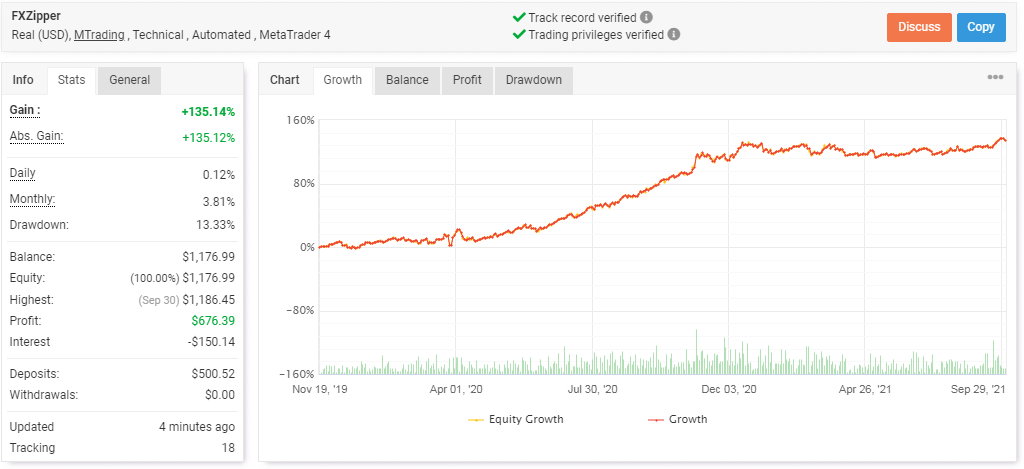

FXZipper live trading account review

The live trading results are available as well.

FXZipper’s live trading results

The account was launched on November 19, 2019, and till now, it has grown by 135.14%. It was initially deposited at $500.52, and only a meager profit of $676.39 has been made to date. This is because the EA only makes a profit of 3.81% monthly. Furthermore, the risks involved in trading are way higher (13.33% drawdown rate) than the rewards obtained. Based on the current statistics, the risk/reward ratio is about 3.5:1. This is obviously not a good sign.

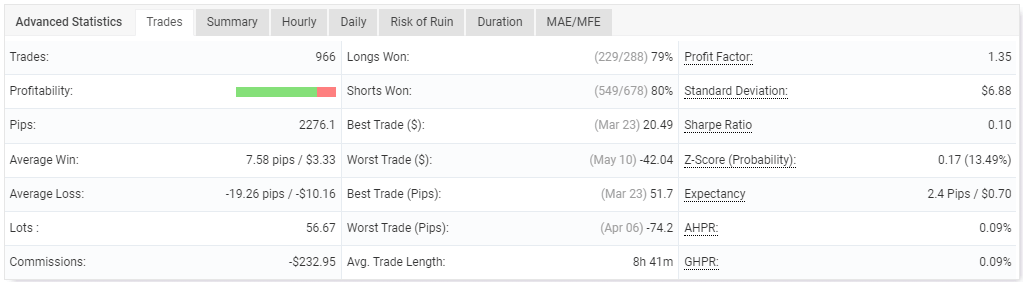

Trading performance

With an average trade length of 8h 41m, the system has managed to engage in 966 trades. However, not all were successful. We see that 79% of the long positions and 80% of the short positions ended up with wins. The profit factor of 1.35 is poor. The unsatisfactory performance of the robot is further depicted by the pips made. The average loss (-19.26 pips) is 2.5 times higher than the average win (-19.26 pips).

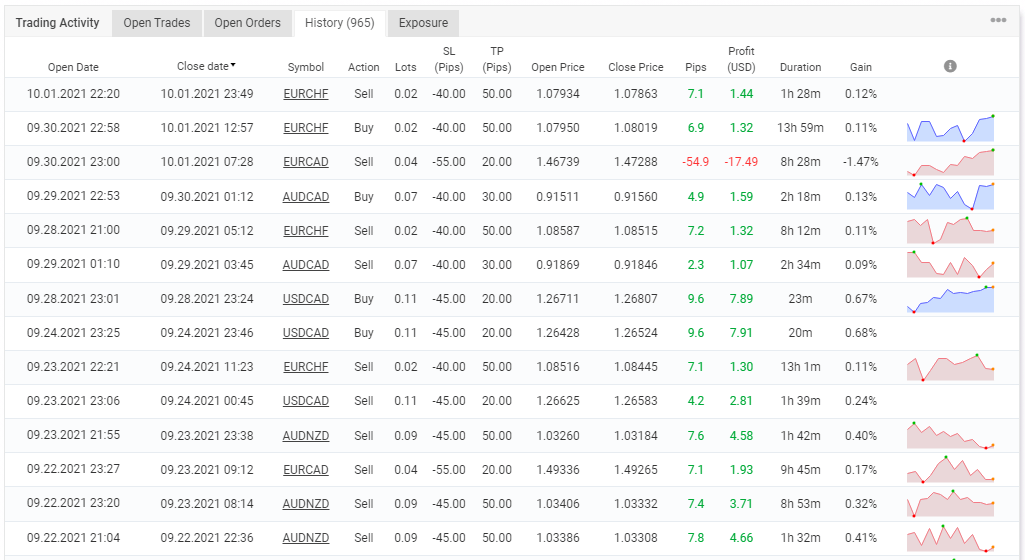

Trading history

It is clear that the robot preferred to capitalize on short time frames. The gains made were small. The bot made a large loss of -$17.49 that rendered the 4 previous profitable occasions useless. The bad trade completely eroded the profits.

Pricing

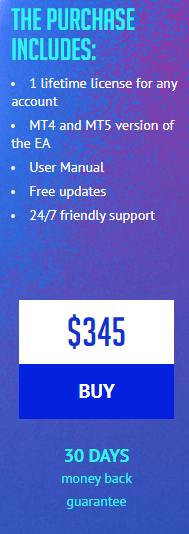

FXZipper is sold at $345. It is quite pricey compared to other robots in the market. We say this because we have come across EAs that cost $200 and below. The vendor provides a 30-day money-back guarantee.

The EA’s price

Is the FXZipper robot a scam?

FXZipper seems like a legit robot. The vendor states that the tool earns an average of 6-12 pips per trade. The trading results have proven this to be true. However, there are some factors that make us doubt the trustworthiness of the robot. These include:

- Lack of vendor transparency.

- Poor risk/reward ratio.

Customer reviews

From the trading results, it is evident that FXZipper has been trading for a long time. Then it is only logical to expect it to have several customer reviews. But it does not. This is fishy. Perhaps traders are not interested in a system that takes forever to generate significant gains.

Comments