The developers of Forex Sugar have made the EA available to retail traders for making huge profits in a limited period. The robot works 24 hours, five days a week, using a scalping approach on a large number of price data. You can set it up within seconds using the installation guide on the website.

Forex Sugar Strategies and Tests

The expert advisor does not use martingale or grid strategies which are considered risky. However, it does not have a proper stop loss system as it closes positions only when the indicators line up for an exit. Trade entries are made on the same technical basis. The trading approach consists of a scalping method where the robot can trade on or after the news. It also takes trading volume and tick data into account.

The minimum required deposit is $500 with minimum leverage of 1:500. A considerable margin indicates that the system is quite risky, and the promised monthly returns of 30 to 100% may only be available after experiencing huge drawdowns. You can put this automated software on the 15-minute chart at EURGBP, XAGUSD (silver), XAUUSD (gold), AUDUSD for the best results. As the programming language of the expert is MQL4, you can not use it on trading platforms other than MT4.

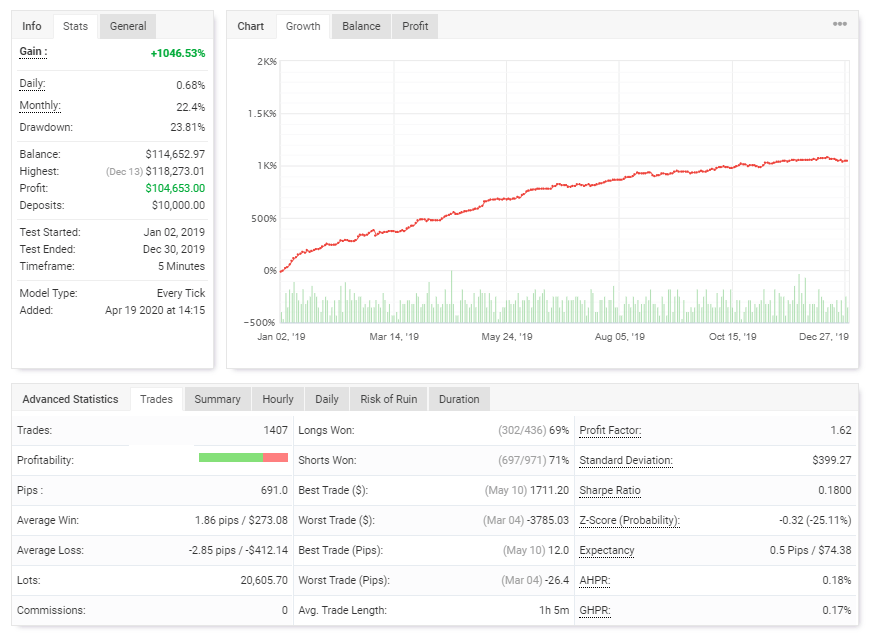

Backtesting results are also available on Myfxbook with a modeling quality of 90%. The settings used in this test are different from FXblue as the robot trades on AUD/USD with an average trade length of 1 hour and 5 minutes. Percentage growth was 1046.53% from January 2019 to December 2019. As the EA shifts from backtesting to a demo portfolio, the results decrease in efficiency, and from this, the performance on a live portfolio is predictable. Meaning the real-time conditions do reduce the output of the expert advisor.

Custom settings

There are various customizable settings that a trader can tweak within the EA for better compatibility. For example, if your broker doesn’t allow hedging, you can turn off the hedging option within Forex Sugar.

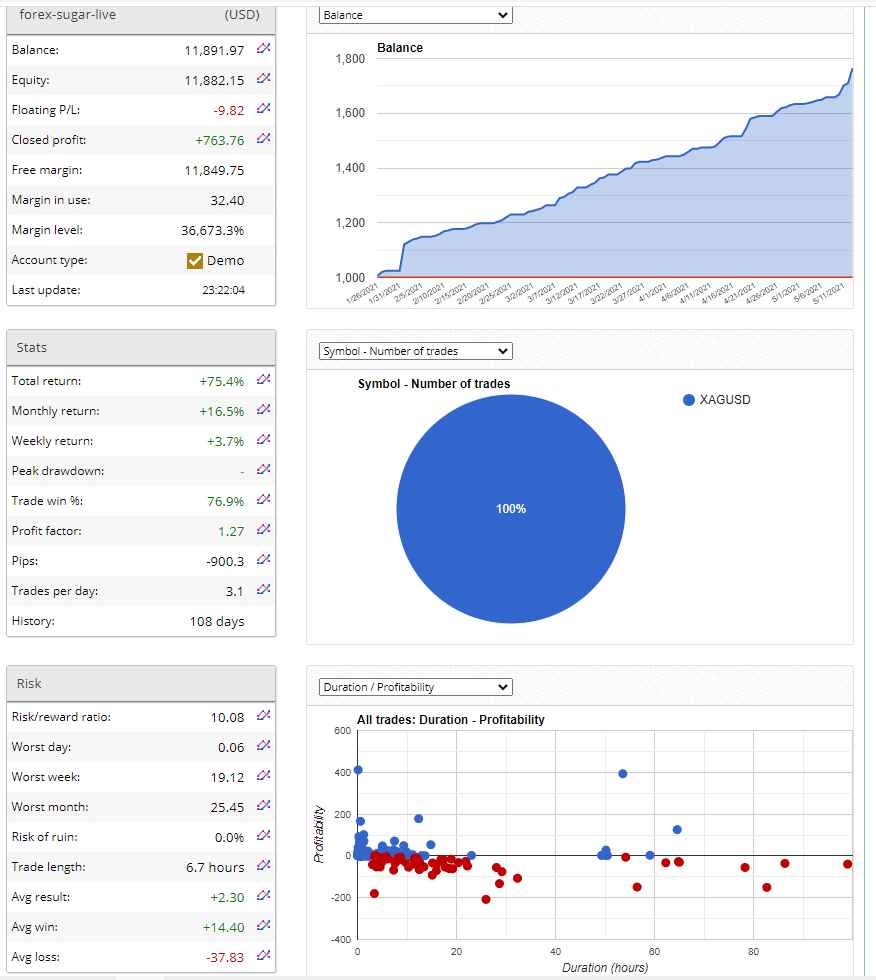

Forex Sugar Live Trading Account Review

Trading records on Fxblue are on a demo account which raises an alert on the authenticity of the robot. Most expert advisors can give good results on a virtual portfolio but fail during live testing. Nonetheless, the trading began on January 27, 2021, and has provided a net monthly return of 16.5%. The risk-reward ratio stands at 10.8 with a high winning of nearly 76%. The results are only specific for one pair – XAG/USD. There is an average of 3.1 trades each day.

Pricing

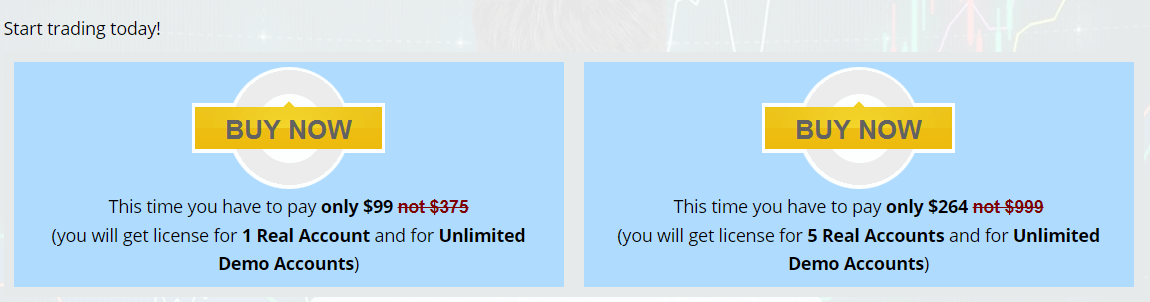

The license for an unlimited demo and a single live account will cost you $99, while the one for five live portfolios is available for $264. Payments can be made via PayPal. For a system that only has profitable results on the demo with inadequate information on statistics, the cost is average for this standard. The best EAs in the industry with verified results on live accounts cost around $500.

The developer warns of price hikes at any moment. However, that is highly unlikely as the actual price is way high.

Is Forex Sugar a scam?

Without any recognized live results, it is hard to say about the future performance of the robot. While the system may give good results on demo, the actual slippage and spreads in real portfolios can render it useless as it capitalizes on news events. The PayPal option is safe in this regard as you can file a claim and get your money back if you prove your case.

Comments