DDMarkets uses a detailed analysis to send out their signals. The company aims for a higher risk-reward ratio and trades on multiple instruments with varying trading styles. They also offer education for beginner and amateur traders to help smooth out the learning curve.

DDMarkets strategies and tests

After making a purchase, the company will take your email into account and send signals through the channel. Traders will then have to copy the positions from there.

Strategy explanation

The company states that they prefer to use longer time frames such as daily, weekly, or monthly charts for their analysis. They aim for a risk/reward ratio of 1:3. We can point out the key points of signals as follows:

- The signals are based on technical and fundamental analysis and come with a stop loss and take profit.

- The duration of the positions is estimated based on economic factors.

- The maximum number of trades open at one time is not more than 4.

- The signals come with a complete analysis that is published within the delivery section on the website made for members.

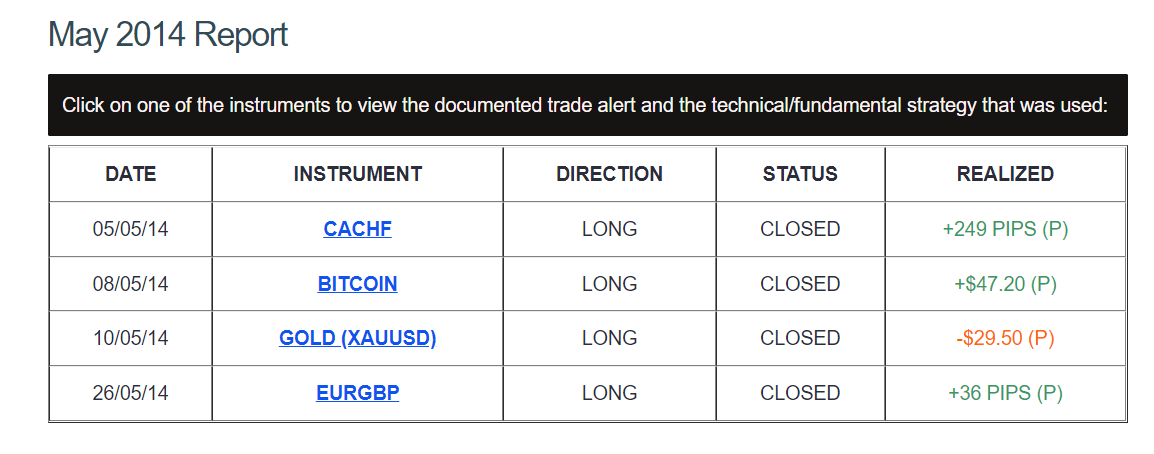

The company does not share its Myfxbook records. They track their records through the website and share the closed positions, which is a flawed approach. We can not look at the trading history this way as it is quite easy to manipulate the records.

Features

The company has the following features:

- They present multiple strategies through which traders can choose from

- They offer signals on Forex and cryptos and have various trading styles such as swing and day trading. Traders can select the one that suits their needs

- The signals come with a detailed analysis and stop-loss

- Various plans are available on the website, which differ in terms of duration. This presents a range of choices to choose from

Backtesting

The company does not present any backtesting results with its strategy. They could have utilized a Forex simulator to test their game plan for a historical record and share the output with us. The lack of available records is a red signal for the program.

DDMarkets live trading account review

DDMarkets only shares their records through personal tracking. There are no verified live trading records available through noted websites such as Myfxbook, which is again a poor practice. This shows that the signals are not profitable, and the company is hiding behind their lacking performance. Tracking the trades through personal records allows easy manipulation. Losing trades can be modified into winning ones to attract traders to pay for the service. Many scammers follow this type of approach in the financial industry.

Records on the company website

Pricing

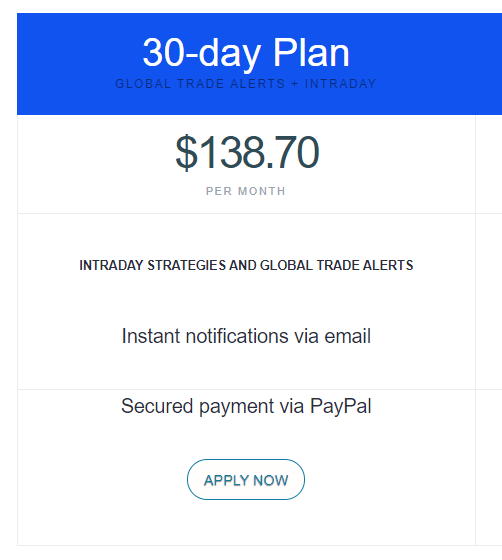

The service is available through multiple packages that differ based on the strategy and the duration you get the signals for. The intraday strategy 14-day plan is available for $49.70. The global trade 30-day plan is for $87.40. It is also possible to buy both for 30 days at $138.70. There is no money-back guarantee, and there are no free trials offered.

The subscription plan of the service

Is the DDMarkets a scam?

DDMarkets are not transparent on their records which raises many concerns. As mentioned before, it is easy to manipulate results when you are tracking them yourself. This type of approach is misleading and links to scam.

Comments