Supply and demand are core terms in financial instrument trading that explain what institutional market participants are doing with the price. The main aim of supply-demand trading is to find the most reliable area from which a higher return is possible with a minimum risk. Moreover, as it explains institutional investors’ sentiment, traders can better understand the price action.

If you are keen to gain from cryptocurrency trading, adding a supply-demand strategy to your portfolio would increase your chance of winning. The following section will see everything a trader should know about supply-demand trading, from basics to advance.

What is the crypto supply-demand strategy?

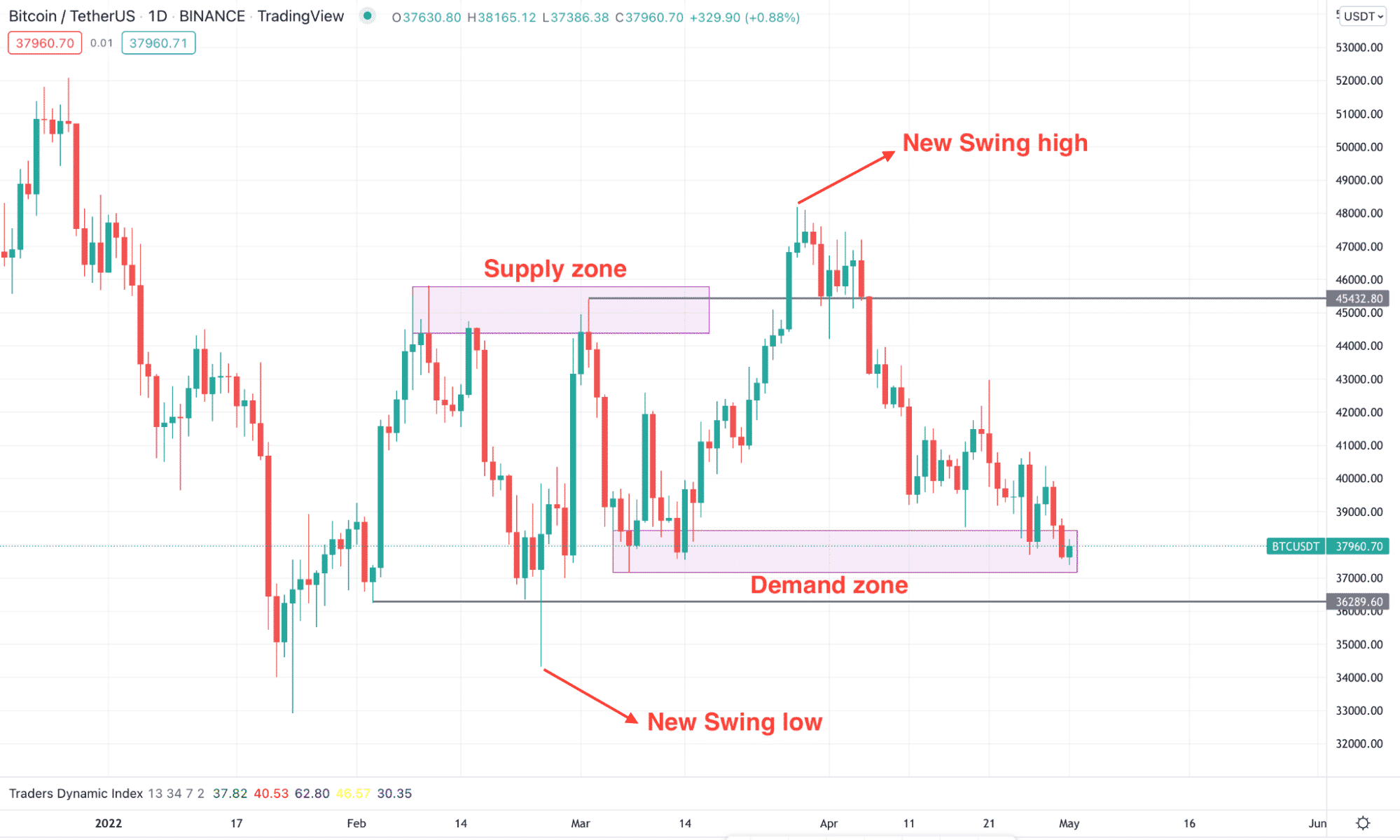

Supply is a price zone where sellers initiate a bearish movement while buyers start to build their position from a demand zone. In the price chart, the supply-demand area is a key zone where sellers/buyers open their trade to grab the maximum benefit. However, the swing level from where a new high or low is created is more likely to work as the supply-demand zone.

Supply-demand zone

As per the above image, the supply zone is the last bullish candle before the selling pressure starts. On the other hand, the demand zone is the previous bearish candle before bulls start the movement.

How to trade using supply-demand in trading strategy?

Trading with supply-demand needs to follow steps rather than opening a trade without confirmation. Therefore, before taking any short or long-term trade, follow these steps in any supply-demand trading.

Find the CHOCH

CHOCH or character change is the first sign of a trend change. The price usually makes new lower lows, but after some consecutive lower lows, the first higher high would be CHOCH. Similarly, after some consecutive higher highs, the first lower low will be the CHOCH. It does to offer any trading entry, but it is the first of the trend change, and a trading entry comes from further confirmations after the CHOCH.

CHOCH in the Bitcoin price chart

Identify order block

Order block is a zone or combination of candlesticks representing the world inside a supply/demand zone. After the CHOCH, the price is shown to make a supply or demand zone, and after that, it will come back to the order block to retest the zone. We are interested in opening trades in this method once it reaches the order block to retest.

Rejection

There are two ways to take the trade:

- The first is to open the trade immediately after reaching the order block. In that case, investors don’t have to wait for rejection, but this approach needs closer attention to the order block’s strength and price action.

- On the other hand, the ideal approach is to wait for a rejection from the order block and open the trade once the rejection is completed.

A short-term trading strategy

The method is applicable in both bearish and bullish markets, but traders should ensure that the long-term trend is valid for taking the trade.

Bullish trade scenario

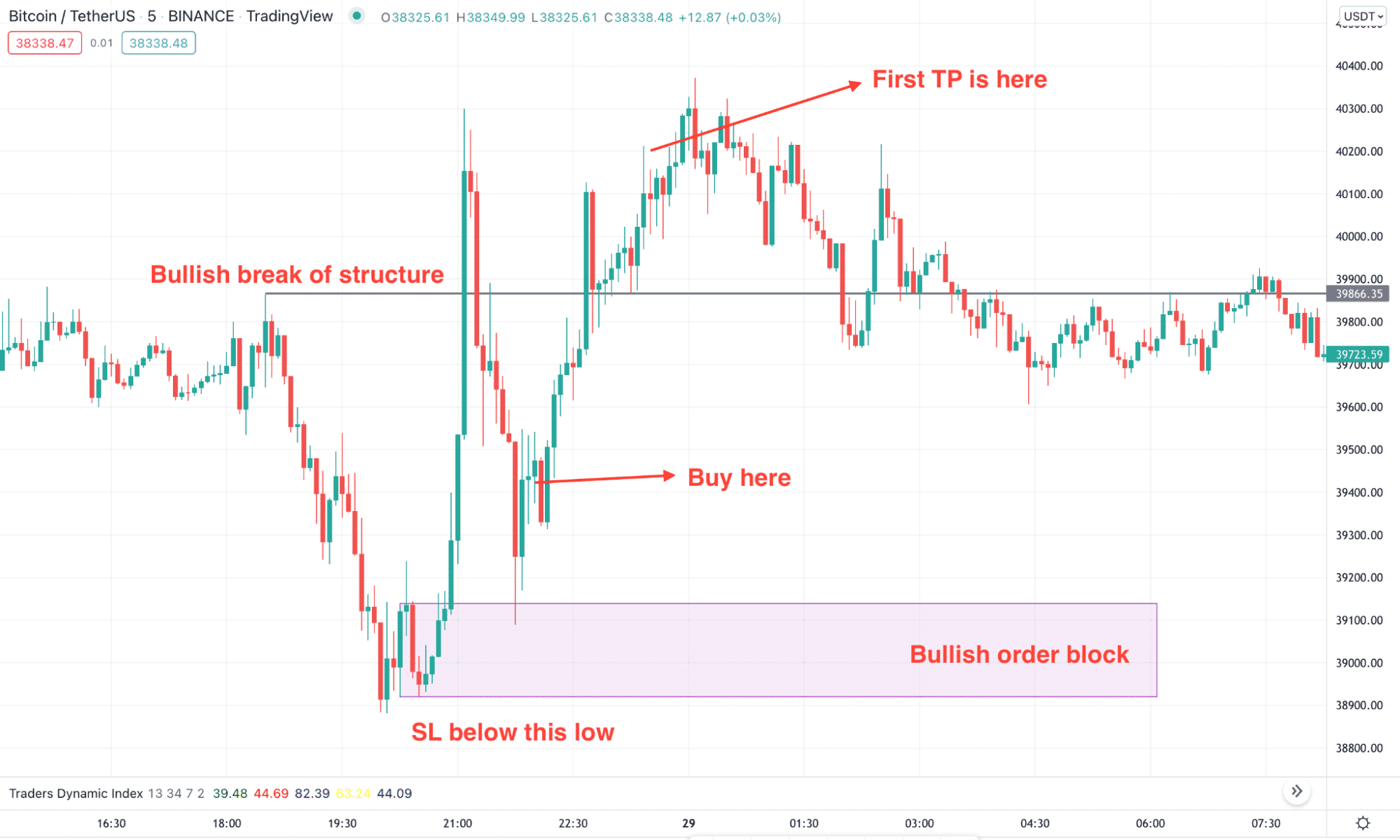

It offers a bullish opportunity where the crypto bull run is happening, intending to boost the profit from the short-term price fluctuation.

Entry

Before opening a bullish trade, find these steps in the chart:

- The current price is heading up from the higher time frame demand zone, and there is a gap between the current price and the near-term supply area.

- The price approached the demand zone and rejected the level with a bullish candlestick.

- Open the buy trade after the candle closes.

Stop-loss

The stop loss should be below the order block with some buffer.

Take profit

The first take profit is the swing high of the current trend, but you can hold it for further profit if the bullish pressure is strong.

Short-term bullish example

Bearish trade scenario

It offers a bearish opportunity where the crypto bear run is happening, intending to boost the profit from the short-term price change in the CFDs trading.

Entry

Before opening a bearish trade, find these steps in the chart:

- The current price is heading down from the lower time frame demand zone, and there is a gap between the current price and the near-term demand area.

- The price approached the supply zone and rejected the level with a bearish candlestick.

- Open the sell trade after the candle closes.

Stop-loss

The stop loss should be above the order block with some buffer.

Take profit

The first take profit is the swing low of the current trend, but you can hold it for further profit if the selling pressure is strong.

Short-term bearish example

A long-term trading strategy

The method is perfect for buying or selling a crypto asset to grab the full juice. Traders usually make 100% to 100K% profit from a single trade in the cryptocurrency market.

Bullish trade scenario

The bullish trade scenario shows the perfect time to open a trade when the bearish rally is completed, and the price is likely to start the bull run.

Entry

Before going long in the higher time frame, find these conditions in the chart:

- After a long bearish trade, a CHOCH has appeared, indicating that the trend is likely to shift from bearish to bullish.

- Price made another higher high after the CHOCH by creating a demand zone, our point of interest.

- Price should return to the demand zone and form a bullish rejection candlestick to validate the buy trade.

Stop-loss

The ideal stop loss is below the demand zone with some buffer.

Take profit

The profitability depends on the character of the crypto token, but before aiming for benefits from long-term HODL, investors should close some positions from near-term swing highs.

Long-term bullish example

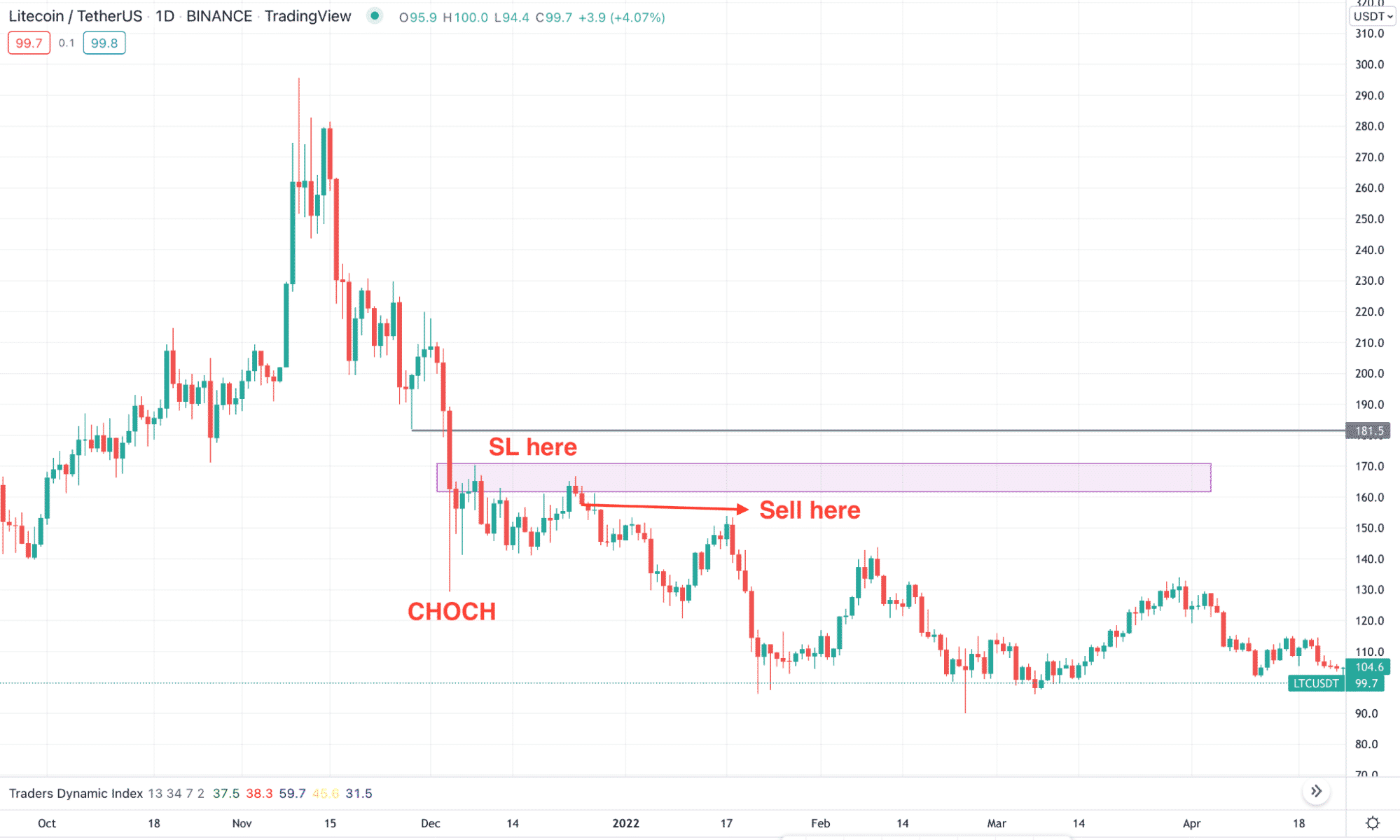

Bearish trade scenario

It is the opposite version of the bullish rally that traders can use to make profits even if the cryptocurrency loses its value.

Entry

Before going short in the higher time frame, find these conditions in the chart:

- After a long upside pressure, a CHOCH has appeared, indicating that the trend is likely to shift.

- Price made a new lower low where the swing high of the leg is our point of interest.

- Price should return to the supply order block zone and form a bearish rejection candlestick.

Stop-loss

The ideal stop loss is above the demand zone with some buffer.

Take profit

The profitability depends on the character of the crypto token but before aiming for benefits from long-term HODL.

Long-term bearish example

Pros & сons

| 👍 Pros | 👎 Cons |

|

|

|

|

|

|

Final thoughts

In the last section, we can say that supply-demand is a highly profitable method to make money online where investors can make a massive ROI in long-term trading. Overall, the following trade management and technical analysis would provide the outcome of the supply-demand crypto trading strategy.

Comments