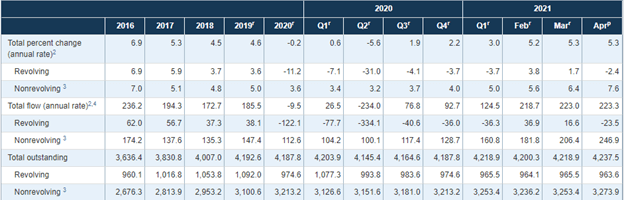

In the first quarter of 2021, US consumer credit increased in a seasonally adjusted yearly rate of 5.3%. The revolving credit declined at a yearly rate of 2.4%.

The non-revolving consumer borrowing increased at a yearly rate of 7.6%. The outstanding non-revolving consumer credit is higher than the revolving consumer credit.

The total outstanding consumer credit as of April increased significantly to $252.4 billion, higher than the past year. The Pandemic hurt the income potential of the consumers, leading to increased consumer borrowing.

The cost of consumer credit has not changed significantly over the last two months in 2021. The new car loans remained 5.21% for the first quarter for 48-month loans. The 60-month new car loans remained at 4.96%.

The outstanding consumer borrowing level in April increased to $4,184.3 billion from $4,163.2 billion in March.

Source: The Federal Reserve.

Comments