Aura Pro is a fully automated grid trading bot that uses risk management techniques to trade the markets. The algorithm uses a magic number to place and control the current executions and comes with a time filter to control the trading hours. The developers present an FAQ and detailed recommendations for traders that we will review in our article along with other key metrics such as drawdown, profitability, etc.

Developer information

Stanislav Tomolic is the author of the product, who is based in Russia. The developer has 9 EAs and 17 signals available in her product list.

The author has a 4.3 out of 78 reviews on the MQL5 marketplace, with a total of 198 subscribers for her services. Traders can reach out to her by sending her a message through the website.

Aura Pro strategies and tests

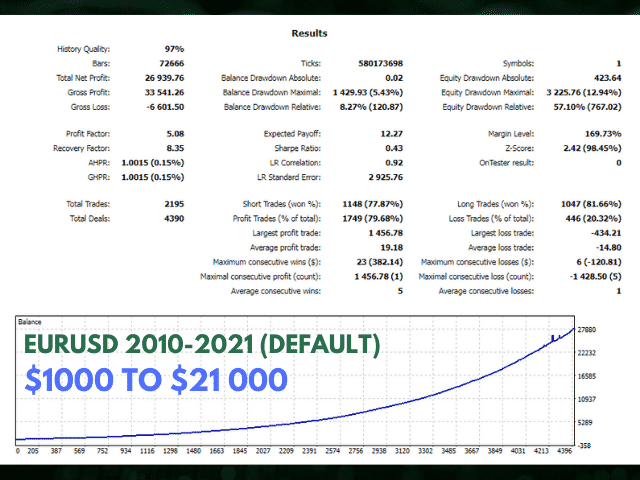

The developers of FXParabol provide the traders with backtesting records from 2010 to 2021. The backtesting was done in EURUSD with an initial amount of $1000 on an unknown time frame. The system made a net profit of $26939.76, where the relative drawdown was seen as 57.10%, with a profit factor of 5.08. The expert advisor participated in 2195 trades and lost 446 out of them. The high drawdown value points out that the algorithm is following risky strategies, which is approved by the sharpe ratio standing at 0.43.

Backtesting records

Features

The algorithm has the following features:

- Allows traders to set up a custom restriction on the number of orders

- Comes with a spread filter

- Risk management settings are incorporated within

- It has pre-optimized set files

- Easy to install

The robot uses grid and martingale strategies based on self-learning mechanism. Hyperparameters are used to control the learning process and find the best set files. It works on EURUSD, GBPUSD, EURGBP, EURCAD, USDCAD, EURCHF, and GBPCAD during the H1 timeframe.

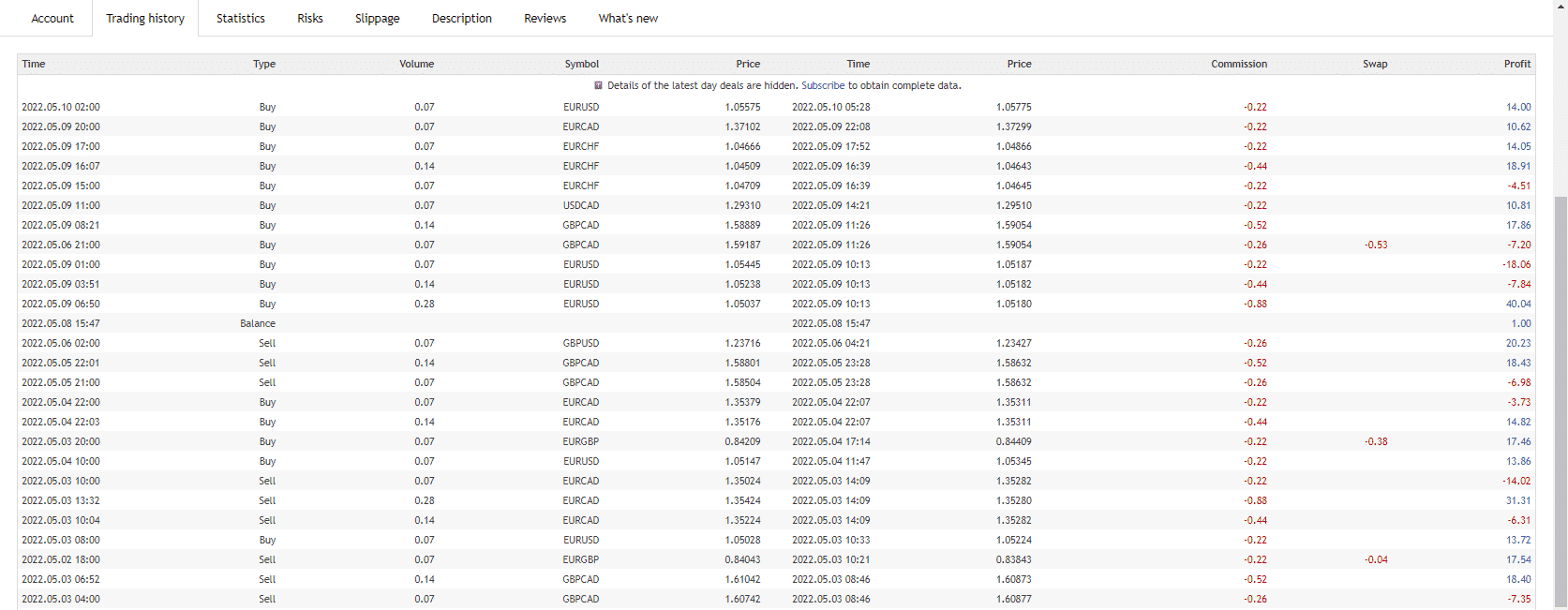

From the history on MQL 5 records, we observe that the system uses a 2x martingale multiplier with trades. After a position turns into a loss, it will open the next trade with twice the lot size as the previous one. The initial trade is placed according to the hourly candle, while the second one opens whenever the designated pip step is reached.

History of the EA

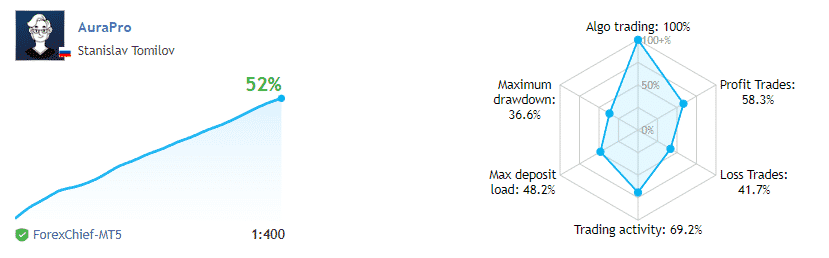

Aura Pro live trading account review

Live trading results have been made available on MQL 5 signals. The date range of these results is September 27, 2021, until the current date. The leverage used for this session was 1:400. The monthly gain rate is standing around at 5.7%. However, a slightly high drawdown value of 36.6% puts the gain rate into question.

The robot participated in 963 trades, of which 41.74% resulted in a loss. The profit factor stands at 2.72, with a very small sharpe ratio of 0.08. The algorithm is currently working at a borderline performance. With a high martingale multiplier, the drawdown can significantly increase in the future.

Live performance of the EA

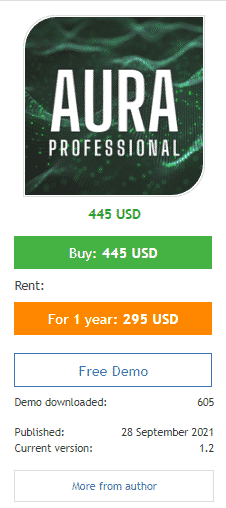

Pricing

The algorithm is available via buy from the MQL5 marketplace for $445. Traders can also rent it for 1 year at $295.

Price of the EA on MAL5

Is Aura Pro a good system to rely on?

The algorithm has 5 reviews on the MQL5 marketplace where a trader comments that the robot will blow up your account sooner or later.

Customer feedback on MQL5

Comments