The US house prices will rise by a further 10.3% this year, according to a survey conducted by Reuters on property analysts.

Source: Reuters

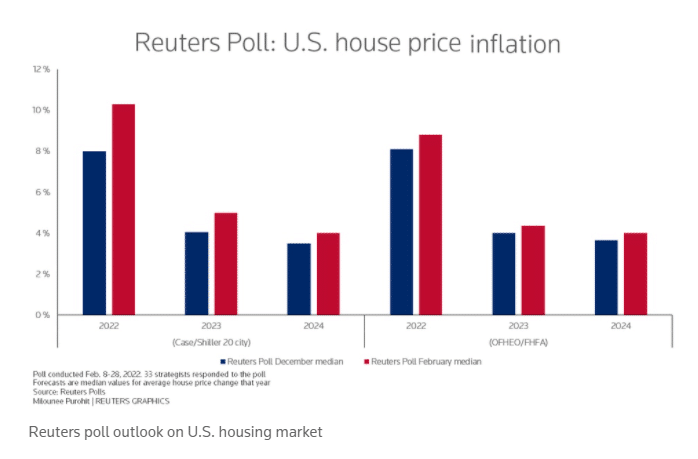

US House Price Inflation

SPY is up +0.50%, DXY is up +0.28%.

The analysts project the uptick in house prices to be connected to the scarcity of units on sale, record low rates, and explosive demand in the pandemic era.

Hunter Housing Economics head of Brad Hunter says the recent rise in home prices are unsustainable, although he expects this year’s increase to be just under 8% and by 4.1% in 2023.

House prices are projected to rise by 5.0% in 2023, and 4.1% in 2024, more than initially forecasted 4.0% and 3.7%, respectively.

The property analysts believe a 1.75% federal funds rate is the one likely to slow down the housing market this year, more than 50 basis points from a previous poll.

The housing inventory is expected to continue worsening as high input costs encourage builders to go for expensive homes with higher margins compared to starter houses whose demand is higher.

The projected increase in house prices in 2022 is an upgrade from an expectation of 8.0% in December.

Comments