Can you imagine making money while you are away from work? There is no such way except investment. Among various investment opportunities, forex trading would be the perfect place for you. It gives opportunities to make an unlimited amount of profits from the marketplace.

You have to implement your plan and trading system to become a successful forex trader. Learning the secrets of forex strategies will enable you to increase profitability and catch more potential trades.

Knowing the secrets is also not enough; you need to implement those facts properly for a successful trading career. This article includes a list of the top ten secrets or opportunities for traders. You will understand and use these in your trading to increase your profitability after completing this article.

- Keep a clean trading strategy

- Avoid news, which brings the noise

- Use trading journal

- Learn to lose properly

- Note money management

- Follow the middle path

- Set realistic expectations

- Make a focus on price action

- Check all strategies, choose one, go according to your choice

- Four stages of price movement

- Final thought

Keep a clean trading strategy

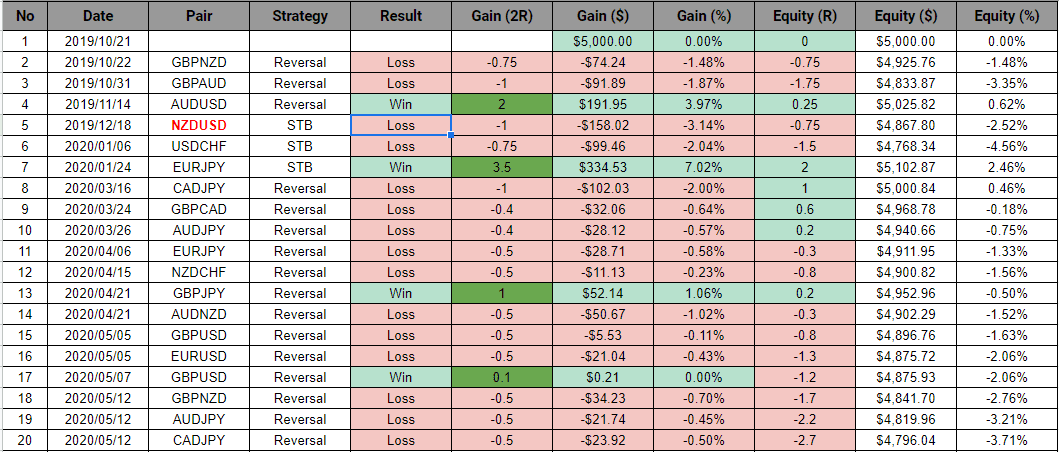

Trading strategies are the methods to approach the FX market, which need to be complete and clean. Complex strategies can create confusion in making trade decisions. Better forex strategies are complete trading systems to make constant profitable trading positions. So the winning ratio must be good for the trading strategy that you choose. You need to backtest the strategy and check the results. Check the number of winning and losing trades and flexibility of the strategy before using it for actual trading.

Avoid news, which brings the noise

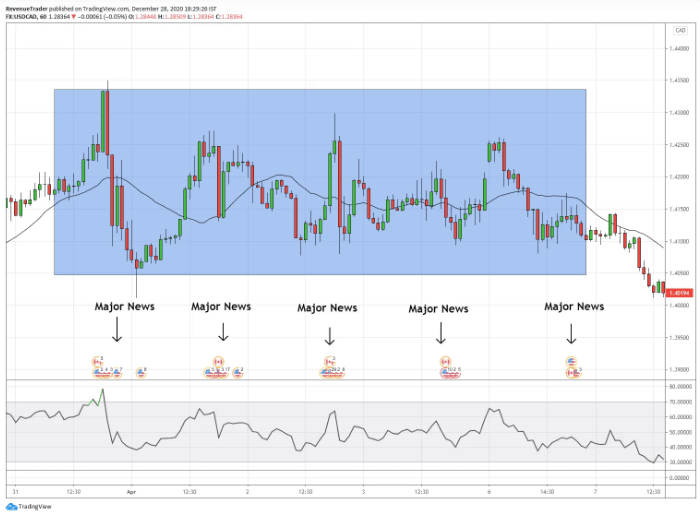

In the FX market, fundamental factors are affecting factors. Although there are many strategies to trade significant economic events, news trading is more like gambling or rolling dice.

USD/CAD chart

The figure above shows five major news impacts on an hourly chart of USD/CAD. Please take a closer look at the chart. It shows unreadable price movements during the news time. After any economic news release, participants take action, it may need some time, and currency pairs show some unusual price movement. So it’s better to avoid trading during significant economic events and news releases.

Use trading journal

Keeping trading journals is essential to become a successful FX trader. It will introduce you to your trading style, mistakes, growth, and several other factors. You can identify your trading mistakes and avoid them in the future. Eliminating errors will lead you toward perfection, also increase your confidence and profitability.

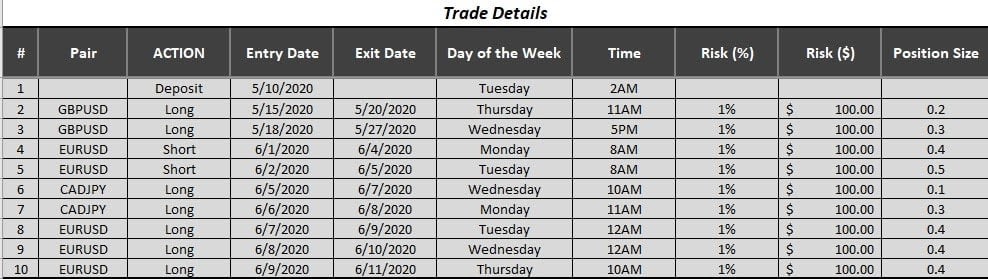

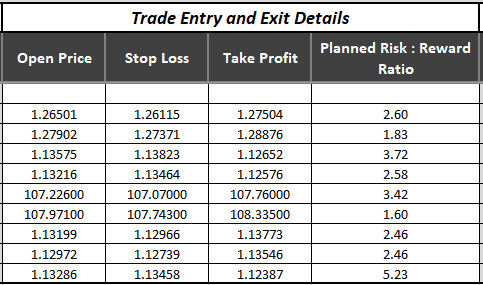

Trading journal

The figure above shows an example of a trading journal. You can also note your trade details like entry exits.

Trading journal information

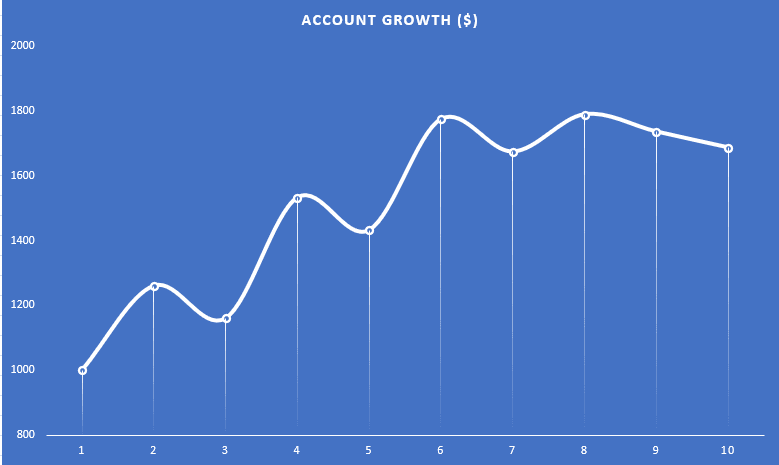

You can count winning and losing trades in the journal. Moreover, you can check current growth by using a trading journal. Successful traders always keep trading journals to improve their performances.

Account growth figure

Learn to lose properly

No forex trader always wins. Every forex trader has losing trades. Losing trades causes stress to market participants. Often newcomers ignore the losing trades and try to recover as soon as possible. That may lead them to revenge trading or emotional trading and reason to lose more capital.

On the other hand, successful traders go through the losing trades, sort out the issues and try to avoid them in the future. As a result, the number of losing trades will reduce in the future. So if you lose, learn to utilize losing trades.

Note money management

The term “money management” is planning, utilizing, and monitoring the trading capital. Money management is essential as most newcomers lose their capital by ignoring money management rules.

There are several money management rules to follow: the 2% rule, fixed fractional, fixed ratio, optimal F, secure F, etc. These are the top five money management rules. If you still don’t use any money management techniques, then choose any one of those.

Follow the middle path

The middle path is an inspiration term from the Buddha. Following the middle path in trading is always the best way for market participants. In FX, traders may get excited by making profitable trades in a row and start making wrong decisions for overconfidence and end up losing money.

On the other hand, a trader may have some losing trades in a row, and fear starts to control their trading decisions by losing their money for emotional trading. So it’s better to stay on the middle path to avoid emotional trading.

Set realistic expectations

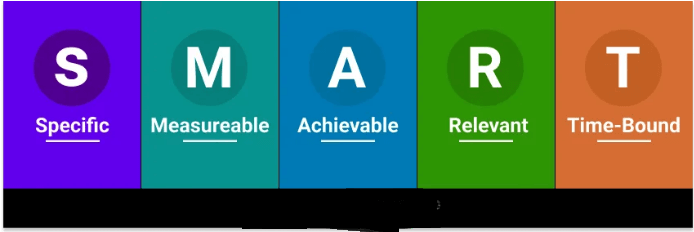

The FX market has the potentiality to give opportunities to individuals for achieving financial freedom. The fact is you should set a realistic goal that you can reach. If you want to be a millionaire overnight, that would be very unrealistic. Your expectations should be reasonable in terms of risk-reward and profit expectations.

Check factors of trading strategies

Check that your trading expectations are appropriate, measurable, specific, achievable, time-bound, and relevant to your trading capital and method. You can not be a successful trader with a trading strategy that has unrealistic expectations. Better have an annual goal than daily, weekly or monthly. So you don’t have to rush to achieve goals and can focus better on the trading style. For example, a monthly 50% profit expectation is unrealistic when most successful traders expect 5-10% monthly profits.

Make a focus on price action

The market has its language to speak, and that is price action. Price action reflects the trading actions from the banks, financial institutes, and retail firms. Focusing on price action can lead you to ride with the big boys and make constant profits from trading forex.

The strategies that include price actions give more profitable and efficient trading suggestions than other trading strategies. On the other hand, most technical indicators are mathematical terms that work with various market data to predict future price movements.

Check all strategies, choose one, go according to your choice

You have to select a trading strategy that suits the trading system and capital. So you must check different types of strategies and learn about them to choose the best one for yourself. Checking includes backtesting, profitability, simplicity, potentiality, etc., of the trading plan.

You can always change and adopt another strategy, but you should check the procedure properly before choosing. Otherwise, you can lose money.

Four stages of price movement

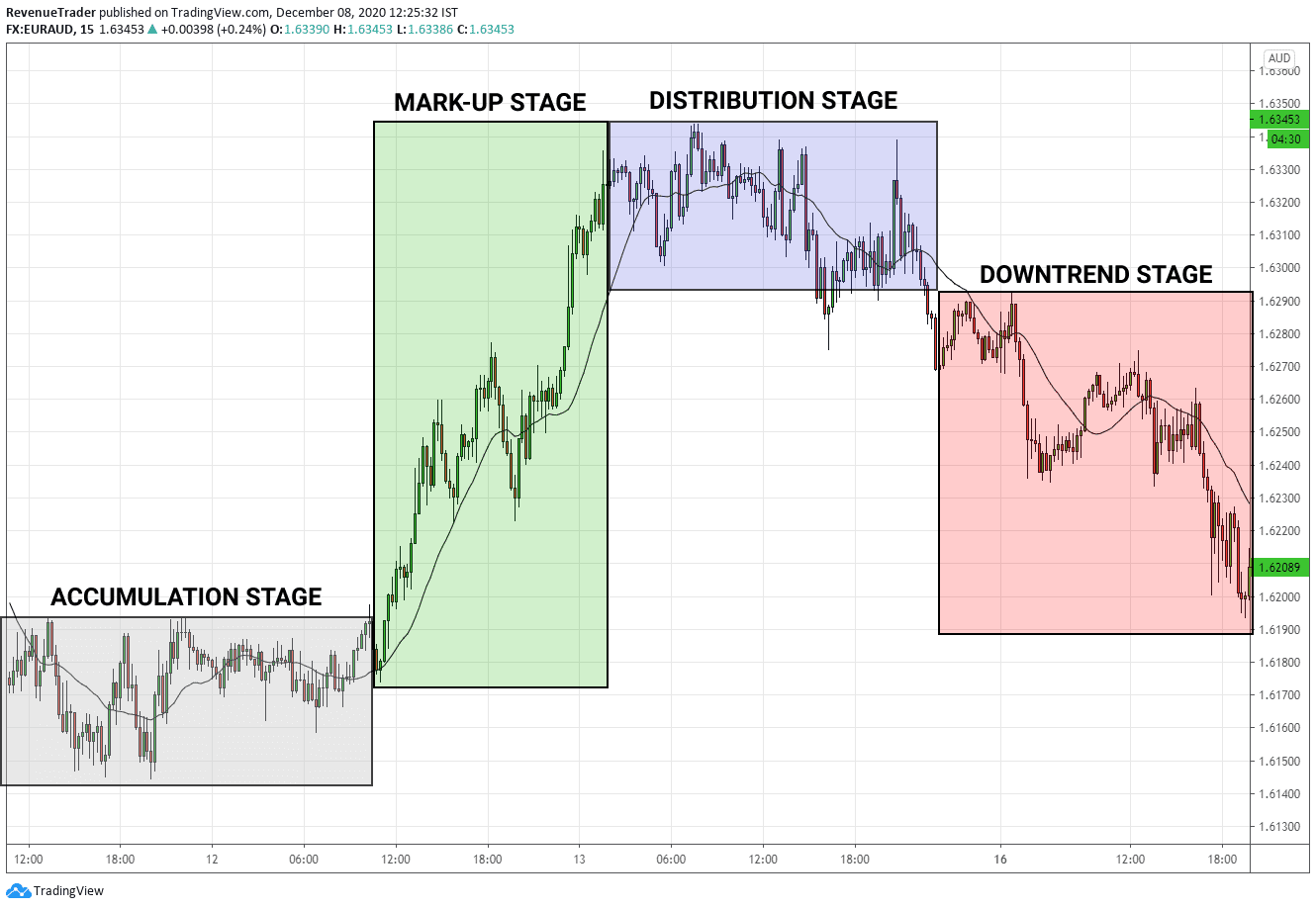

There are four types of price movement you can see at the currency pairs. Those are the accumulation stage, mark-up stage, distribution stage, and downtrend stage.

Price movement cycle

The figure above shows the different stages of price movement. When you identify those stages on your trading chart, you will make more profitable trading positions than average traders. Price movements leave footprints when they change. When you can read those footprints, you will be further ahead toward a successful trading career.

Final thought

These are the top factors you should consider before starting your trading. You need to follow these to achieve the goal of being a professional forex trader. There are lots of trading strategies you will find across the internet. We suggest choosing carefully by checking and observing the results.

Comments