Cryptocurrency traders are using derivative markets and deleveraged positions to hedge out risks amid expected Federal Reserve interest rate hikes in March.

Source: Cointelegraph

BTCUSD is up +3.33%

Data from Glassnode shows that bitcoin outflows have surpassed inflows currently at about 42,900 BTC a month, the highest since October last year.

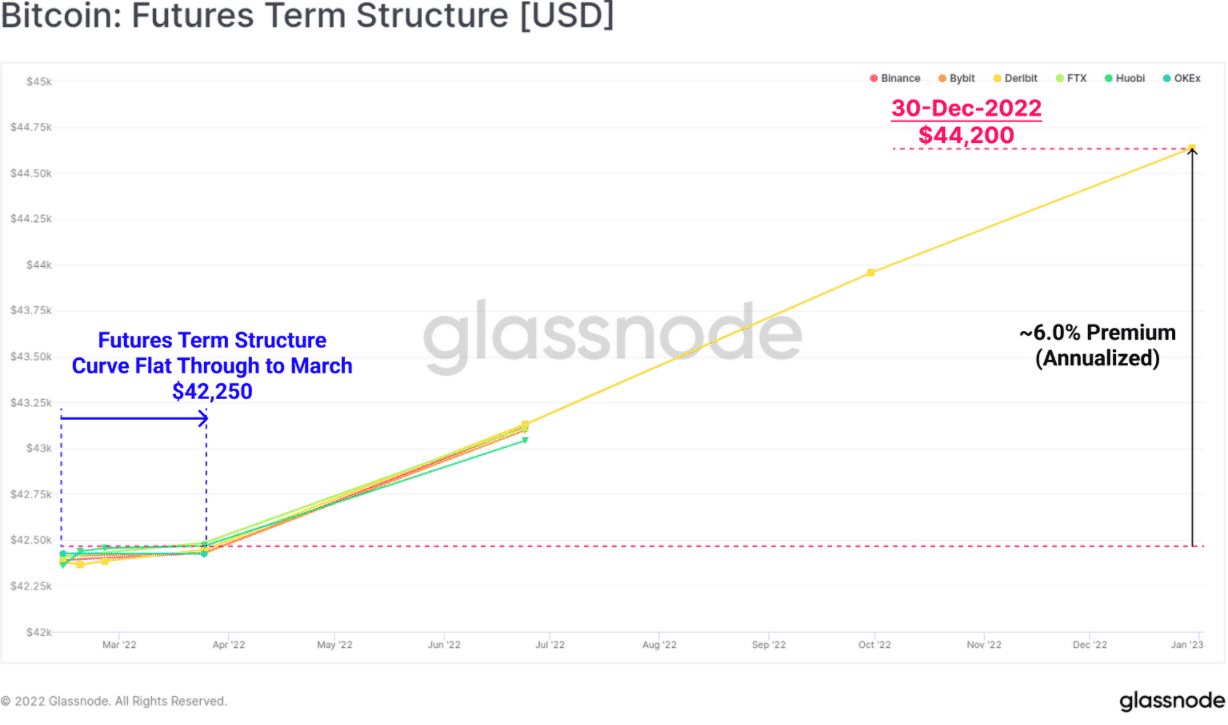

The annualized premium on futures is currently at about 6%, showing that investors are not expecting a bullish momentum up to the end of 2022.

Data from Glassnode adds that the total futures open interest has dropped from 2% to 1.76% in the overall cryptocurrency market capitalization as investors remain conservative.

Tom Lee, Fundstrat’s managing partner, notes that conventional investments like bonds were likely to face challenges ahead due to the interest rate reversal.

Lee projects that more funds will flow from bonds into cryptocurrencies, where investors can earn a return that surpasses the bond yields.

Long-term bitcoin investors hold around 13.34 million BTC, having sold only 175,000 BTC since October last year.

Bitcoin has jumped 4.19% in the past day, currently trading at $43,552.

Comments