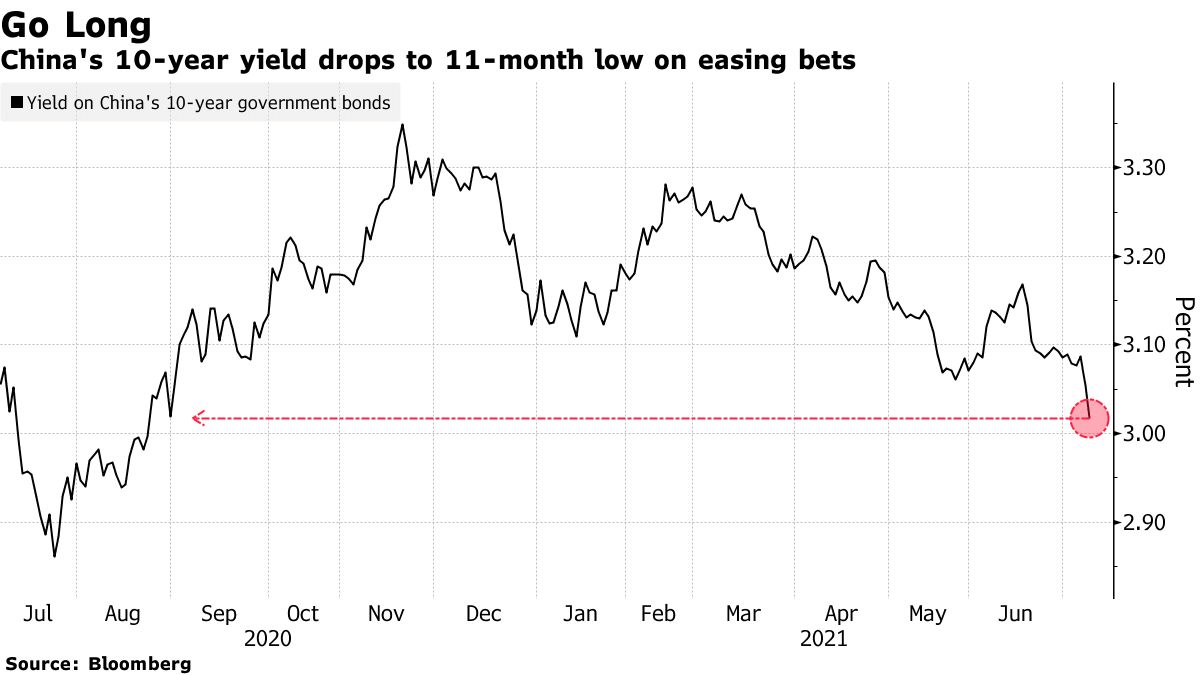

Yields on China’s 10-year sovereign bonds plunged by seven basis points to hit 2.99%, as prices rallied on potential loosening of policy.

Source: Bloomberg

Futures contracts on the 10-year bond rose by the most in over a year while a gauge of trader expectations of borrowing costs plunged to the lowest since January.

The drop in bond yields reflects hints by China’s central bank that it will avail more cash to banks to boost lending and reduce reserve requirements.

China seeks to support the economy after recovery showed sluggishness, with the move expected to provide liquidity to bond markets.

Citigroup Inc. analysts project yields on the 10-year bonds to plunge to between 2.90% and 2.95%

Analysts say the easing of policy will have limited impact on the yuan, with the Chinese currency down 0.2% on Thursday’s risk-off sentiment, while CSI 300 shed 1.2%.

Comments