Thanks to technology, most of our daily activities are getting digitized. It is taking cryptocurrencies investments to the next level of its growth. Many investors do not prefer investing in cryptocurrencies even though they are valuable. The major reason behind this is the price fluctuation of cryptocurrencies. These price fluctuations sometimes are too much to bear for an investor. Hence, novice investors prefer stablecoins in most cases.

However, stablecoins are the crypto-assets backed by the fiat-money value such as a commodity, the USD, and other cryptocurrencies. Stablecoins help to reduce market volatility and keep the currency price more steady. Moreover, stale coins progressively made up an upsurge throughout the years in the crypto world. Currently, different assets have been utilized for backing up stablecoins successively.

Let’s go through a list of the best five stablecoins that have been gaining the attention of the investors and must be watched out for 2022.

Best 5 stablecoins coins to buy in 2022

- Tether (USDT)

- Dai (DAI)

- Binance USD (BUSD)

- TrueUSD (TUSD)

- USD Coin (USDC)

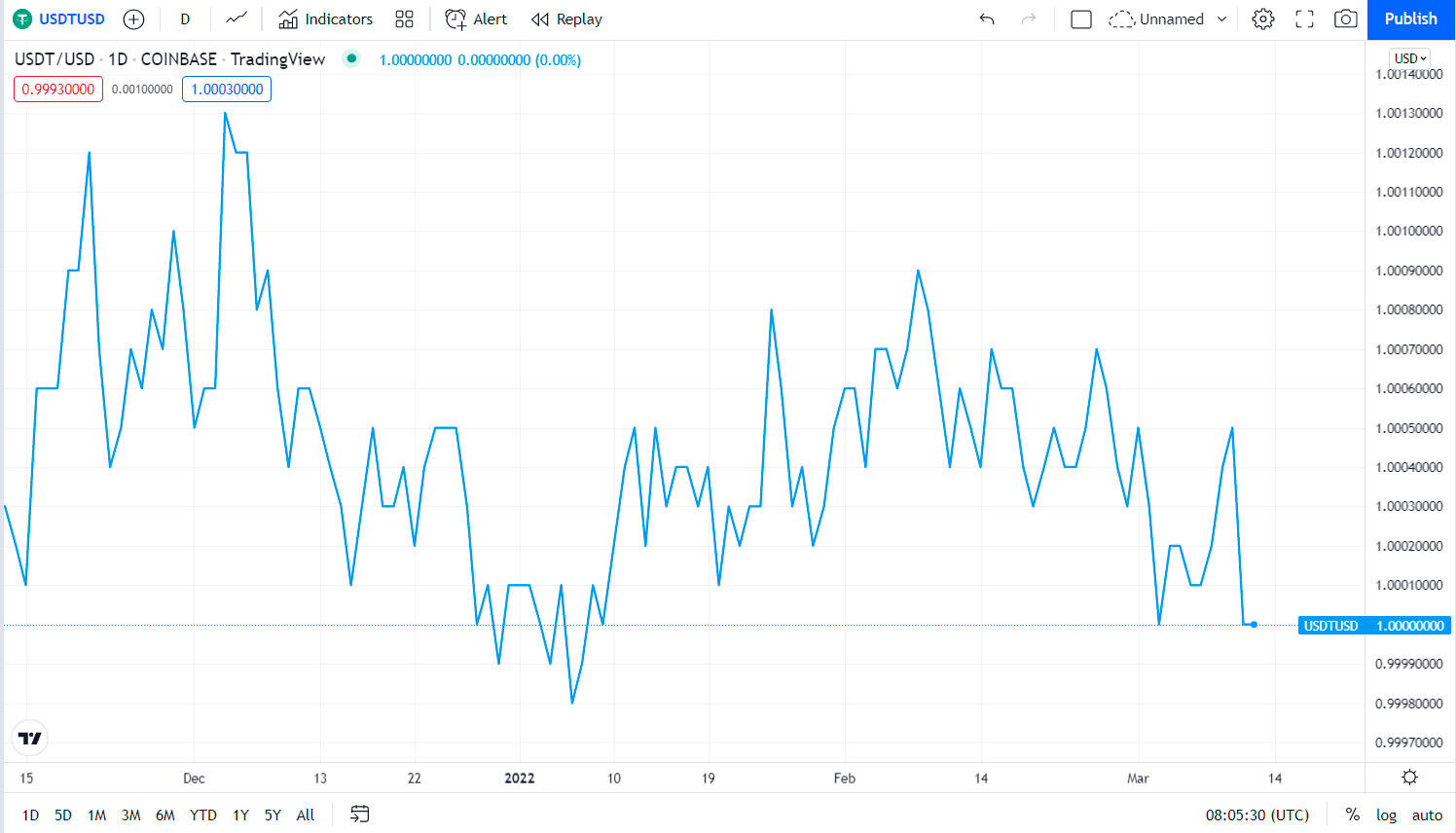

Tether (USDT)

Tether price chart

Tether is a very famous stablecoin that was initially launched in 2014. It is the most utilized stablecoins in the cryptocurrency world. Tether is backed by fiat-cash, US dollars. The basic feature of USDT is that it is exchangeable for US dollars. Precisely, one Tether is equal to one US dollar to be swapped. However, USDT is the prototype of low-risk trading and the anti-market influence in the digital market.

Does Tether (USDT) have the potential to grow?

The coin may not necessarily multiply your money over the long term since the USD backs it. But there are available exchanges, platforms, and wallets for lending. There is a chance to generate income as those lending platforms may offer you high-interest rates for storing USDT in their platforms.

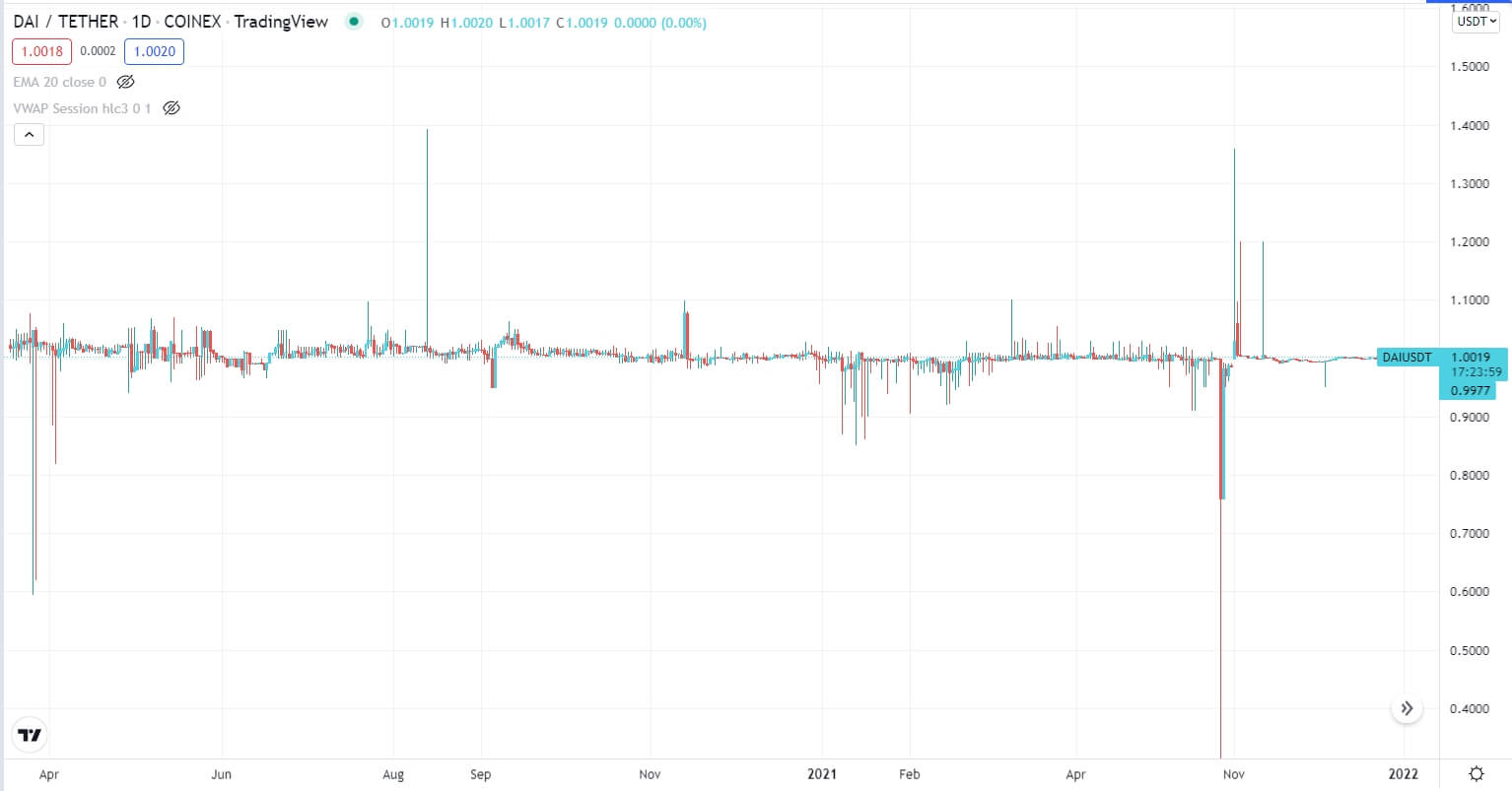

Dai (DAI)

DAI price chart

It is a distinctive stablecoin that is pegged and secured by the currency based on Ethereum. Initially, DAI is deposited into the MakerDAO vault. Afterward, it works as an indemnity for the user for using the DAI. MarketDAO stabilizes the DAI by attaching it to the US dollar at a ratio of 1:1 because the US dollar’s value is less than DAI’s value.

Does Dai (DAI) have the potential to grow?

DAI coin price anticipated for 2022 at $1.01 in 2022, 2023, 2044, and the price will continue until 2031. On the other hand, the price growth is also suggested with the claim of being worth $5.68 in five year period and in March 2024 will break the mark of $2.

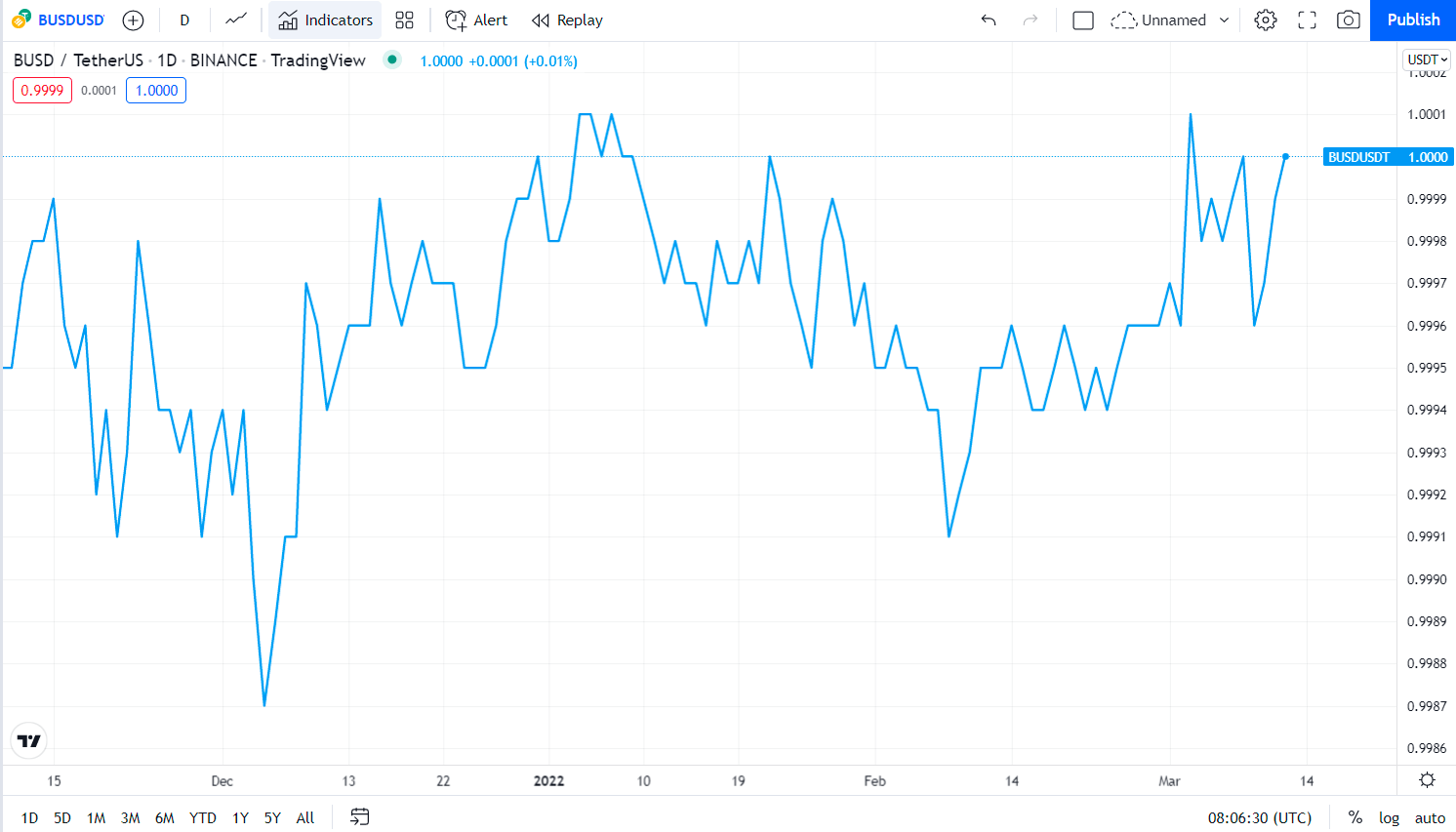

Binance USD (BUSD)

Binance USD price chart

Binance USD is a Binance company that generates well-known stablecoins of the crypto world. Binance USD has extensively utilized technology over the past several years. Remarkably, the Binance crypto has attached to the USD fiat cash.

Does Binance USD (BUSD) have the potential to grow?

Analysts and experts anticipated that the price of Binance USD may increase between 2022 to 2031. However, analysts’ predictions are just an assumption. The risk in cryptocurrency investment is massively high; hence your capital will be at extreme risk. Therefore make sure to gather all the required data before jumping into it. Also, always try to invest rationally.

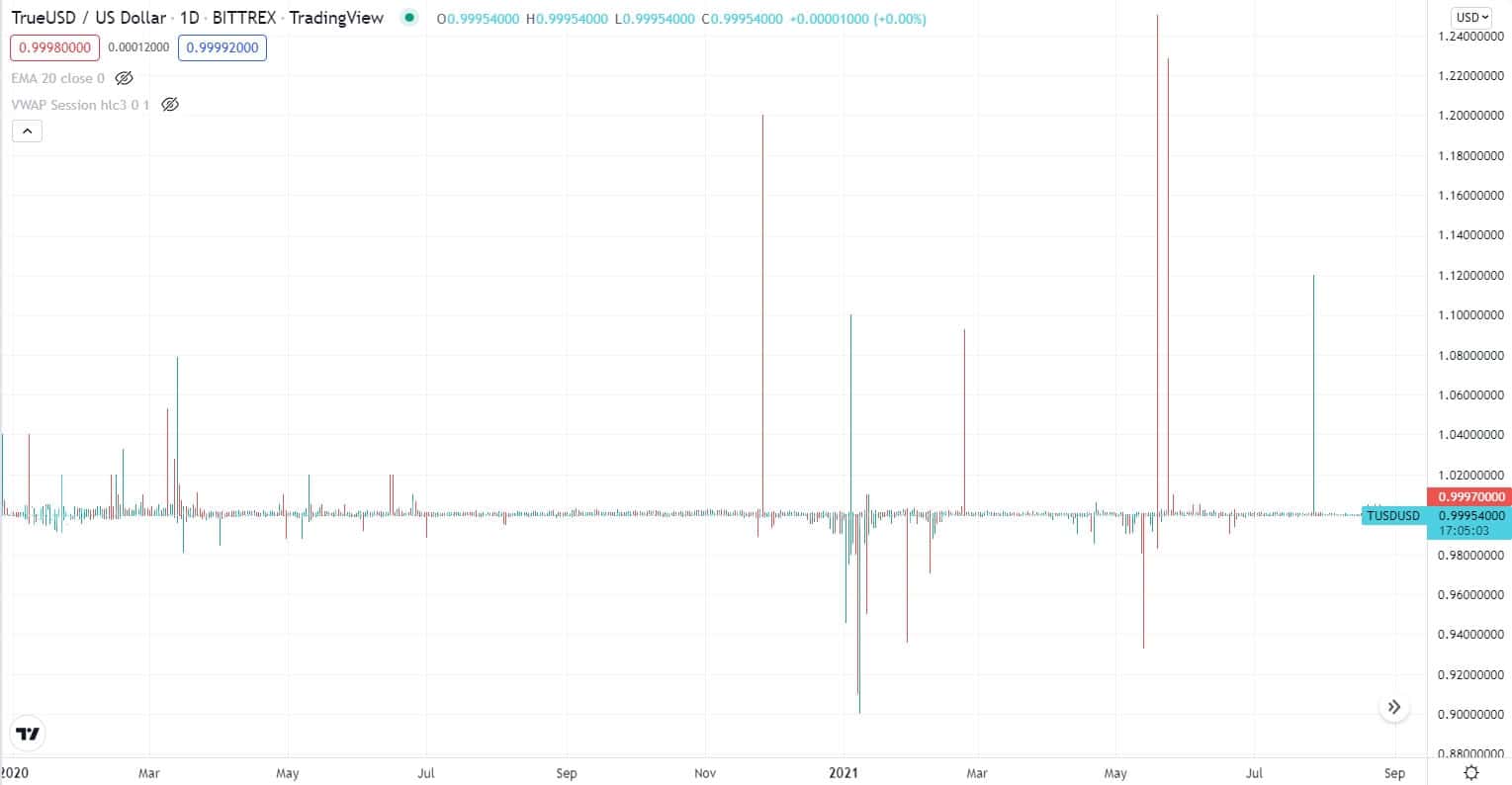

TrueUSD (TUSD)

TrueUSD price chart

TrueUSD is an entirely collateralized stablecoin. It is a highly secured and substantiated ERC-20 token. Similar to the other famous stablecoins, TrueUSD is pegged by the US dollar with a maintained ratio of 1:1. On the other hand, it is the TrustToken platform generated, leading cryptocurrency.

Does TrueUSD (TUSD) have the potential to grow?

According to the expert prediction, the price of TUSD may remain at $1.01 from 2022 comprehensively to 2029. The TrueUSD price is estimated to be abiding by at $1.01 for 2025.

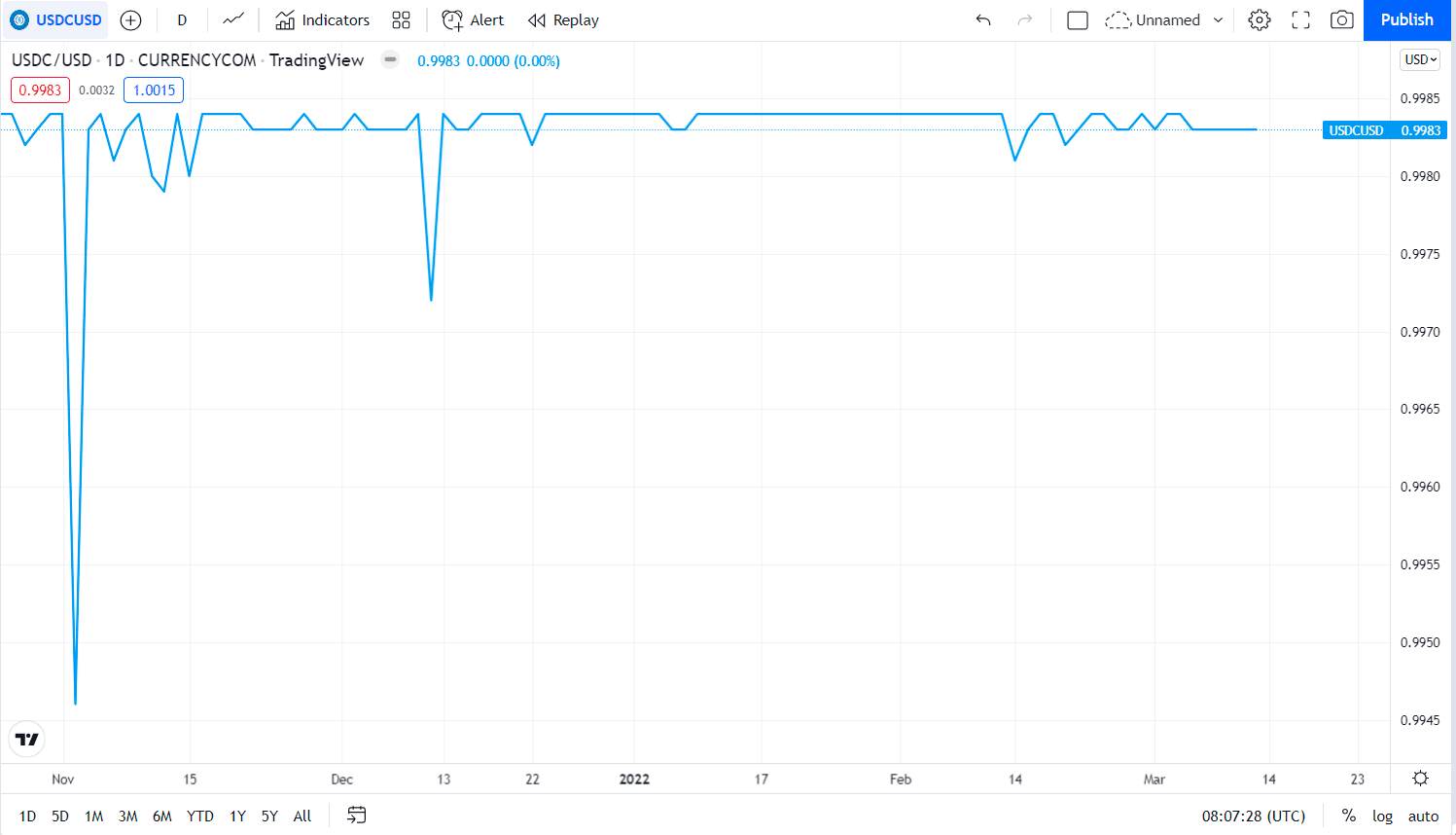

USD Coin (USDC)

USD coin price chart

USD Coin is developed through a joint venture domain of Circle and Coinbase. Like most other stable coins, USD Coin is also attached to US dollars. It is utilized in decentralized finance procedures. Moreover, USD stablecoins are governed by the financial institutions of the United States and are widely used in the crypto space.

Does USD Coin (USDC) have the potential to grow?

USDC’s parent business claims that an investor wishes to move from medium to large quantities of money USD Coin is for them. USDC stablecoin may support cryptocurrencies to be brought into the mainstream by making them more captivating to institutional investors.

Pros & cons

| 👍 Pros | 👎 Cons |

|

|

|

|

|

|

Final thoughts

In conclusion, stablecoins are generally used for arbitrage settlements or as crypto-cash holding, not for high-paying returns. They are generally backed by assets like other cryptocurrencies, fiat currencies, and precious metals. These assets are known as considerably more stable than regular cryptocurrencies.

Stablecoins are valued as the prime mover of the digital economy in the coming days. Added with that, a lot of business platforms are entering this domain for massive profits and rewards. However, stablecoin development is considered the next big bash in the crypto space.

Comments