Introduced to the market in 2017, AVIA is an investment program that claims to help investors reduce their trading risks in Forex. As such, the professionals behind it purpose to manage risks at early stages including preventing major risk events or hedging during times of uncertainty.

LEFTURN is the company that manages the AVIA program. It is composed of a small group of supposedly highly intelligent and ambitious members from all walks of life.

However, the “About Us” page doesn’t reveal much about the developers. There is no information telling us the number of professionals that are involved in the program and their detailed profiles.

AVIA strategies and tests

AVIA manages accounts on behalf of their clients. The program applies what the vendor calls a highly systematic approach that incorporates fundamental analysis and a highly sophisticated technical analysis. The devs also point ut that there are stringent guidelines that ascertain entries and exits from markets in offense mode coupled with where and when to defend (hedge) in defense mode.

From this strategy description, it is clear that we are dealing with a bunch of amateurs. If this team really knew what it was doing, then it would not have a challenge explaining the specifics of the approaches it applies.

The features of the program are as follows:

- VT Markets, LMFX, FBS, CedarFX, HugosWay, and EagleFX are the recommended brokers

- Trades all the main pairs that seek the best low risk trading opportunities

- Works with MT4 accounts

- Requires all trades to be closed prior to issuing invoices

- There are no lock-in periods and therefore, customers can withdraw their money whenever they want

There are several conditions that the program requires the trader’s account to meet:

- The least amount of leverage for accounts <$15k must be 1:500

- Should be permitted to trade micro lots of 0.01

- Hedging and an unlimited number of positions should also be allowed

The developers have not furnished us with backtest results. Therefore, it is difficult to determine how their program performed in the past. Furthermore, we are left to speculate whether their strategy was effective enough to grow their clients’ accounts and keep the drawdown levels low.

AVIA live trading account review

Live trading results can be found on the Myfxbook.com website.

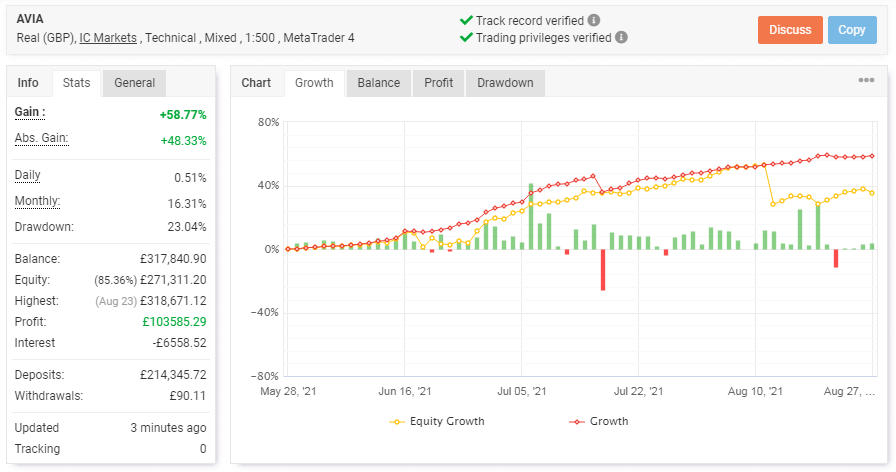

Chart displaying AVIA’s trading statistics

This chart shows that the real GBP account was deployed on May 28, 2021 and we can see that the gain has reached 58.77% already. A profit of £103,585.29 has been made from an initial deposit of £214, 345.72. The amount of money withdrawn from the account is £90.11 and the balance is now £317,840.90.

The drawdown which is 23.04% is big and signifies an account that is making losses at high and worrying rates. The daily and monthly profits are 0.51% and 16.31% respectively. We are concerned that these gains may soon be consumed by the high drawdown.

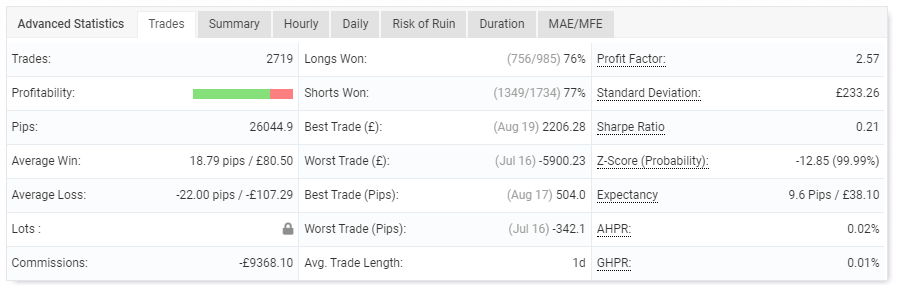

The system’s trading performance

The trades executed are 2719. The win rates for long positions are 76% and 77% for short ones. These results bring to light the fact that the account is struggling to make substantial profits. The profit factor is 2.57.

The pips made are 26044.9. The average win is 18.79 pips whereas the average loss is -22 pips. Again, we see a situation where attempts to make profits are not that successful. More losses are made instead. We do not know the lots traded as this data is hidden.

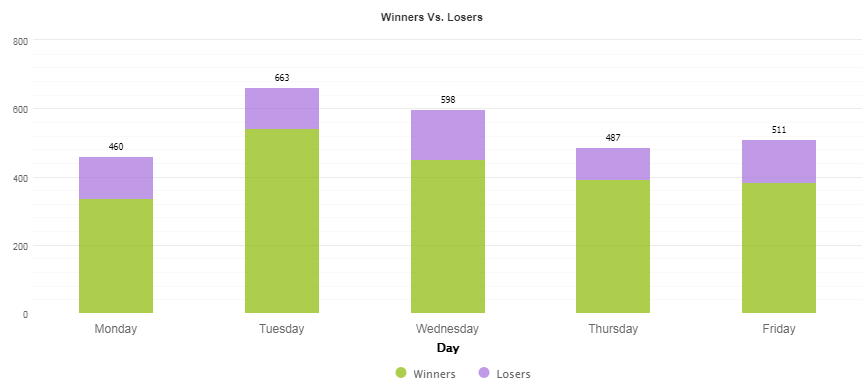

Number of trades made from Monday to Friday

The day with the highest number of trades is Tuesday as it completed 663 trades.

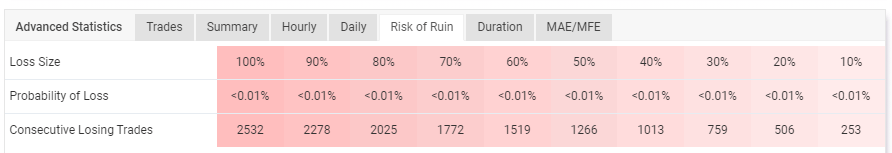

The probabilities of losing the account

The account cannot be easily wiped out.

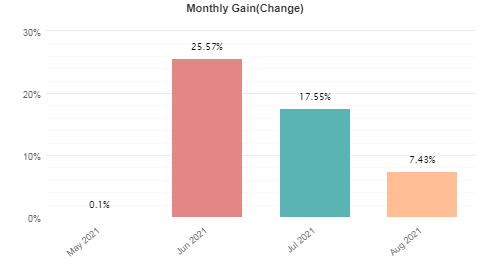

The monthly performance from May 2021 to August 2021

June was the most profitable month (25.57%). May was the least profitable month (0.1%).

Pricing

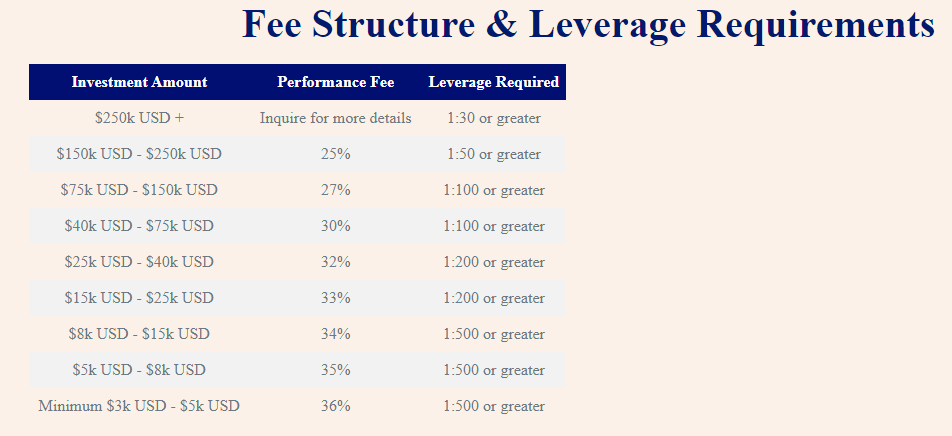

AVIA’s fee structure

The vendor provides traders with various investment options. The minimum investment amount is between $3k and $5k and the leverage requirement is 1:500 or greater. This package will attract a 36% performance fee.

The maximum amount you can invest in is $250k and above, and with this plan, a leverage of 1:30 or greater is needed. You are asked to inquire for more details if you want to know the performance fee charged for this package.

Is the AVIA a scam?

Our review has led us to conclude that AVIA is a scam. The vendor fails to provide the team’s full credentials, backtest results, lots traded and historical data. This indicates that there are unfavorable things about the program the company doesn’t want people to know. We have also realized that the team is incapable of trading safely. The high drawdown is proof enough. So, the developers are only after the investor’s money.

User reviews

User testimonials for AVIA are missing. We could not find any feedback on its official site or on other platforms like Trustpilot and Forex Peace Army. It is very fishy that no customer has come out to narrate their experience with this program since its inception in 2017.

AVIA is a total scam!

Lefturn is not the company to trust. The devs are cheaters who are simply earning money from traders. Without any explanations, they decided to change the URL to their website as well as rebrand their managed account service. Now it’s called Alphi. The system trades with a high risk to reward ratio of 3:1. To sum everything up, Lefturn is not the company to rely on.

Comments